2018-05-23 09:41:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Many U.S. large public corporations spend their tax cuts on new dividend payout and share buyback but not on new job creation and R&D innovation. These public corporations channel $1 trillion onshore and offshore cash stockpiles into dividend and share buyback programs. For instance, Apple expects to spend $100 billion cash on share repurchases from mid-2018 to early-2020. Cisco spends $25 billion on share buyback, and Wells Fargo plans $22 billion share purchases. Google also expects to spend about $9 billion on dividend payout and share buyback in order to boost its near-term stock price prospects. Pepsi, AbbVie, and Amgen collectively spend $35 billion on share repurchases for better shareholder value maximization. Visa and eBay plan to initiate similar dividend and share buyback programs over the next couple of years.

Overall, these public corporations seem to view Trump tax cuts are temporary cash windfalls but not permanent cash gains. These companies initiate cash dividends and share repurchases for immediate shareholder gratification. It is thus less clear whether Trump tax cuts serve as permanent income boosts that can help revive real economic output, employment, capital investment, or R&D innovation etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-08-12 07:25:00 Wednesday ET

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2023-07-21 10:30:00 Friday ET

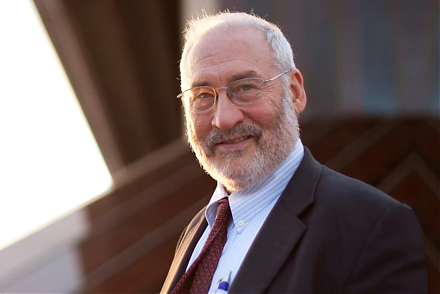

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2025-07-05 11:23:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why working with emotional intelligence helps hone our social skills f

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2018-12-21 11:39:00 Friday ET

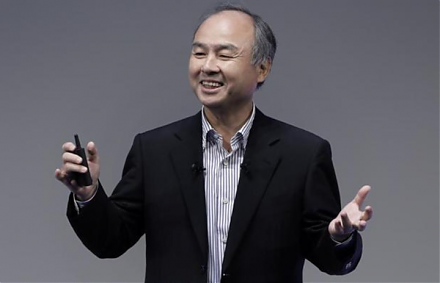

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2019-10-23 15:39:00 Wednesday ET

American CEOs of about 200 corporations issue a joint statement in support of stakeholder value maximization. The Business Roundtable offers this statement