2018-08-05 12:34:00 Sun ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yield. This bullish perspective reduces the relative likelihood of U.S. yield curve inversion that indicates a negative term spread between short-term and long-term Treasury bond yields. A negative term spread or yield curve inversion typically indicates the early dawn of an economic recession. On the basis of recent empirical evidence, this technical macroeconomic prediction has been correct since the 1970s.

Indeed, Dimon points out that the current bull market can run for another 2-3 more years. Dimon's bullish sentiment relies heavily upon the sunny scenario where the Federal Reserve continues the current interest rate hike in response to inflationary concerns. Core CPI inflation and PCE inflation hover around 2%; unemployment declines below 4%; and real GDP economic growth lands in the healthy range of 3% to 3.5% per annum. In other words, the U.S. economy now operates near full employment and productivity growth with moderate inflation.

However, several economists consider the 5% Treasury bond yield benchmark a long shot due to subpar inflation expectations. In the alternative light, these experts suggest that the 5% Treasury bond yield benchmark may not be imminent until the Federal Reserve continues the interest rate hike until late-2019 or even early-2020.

In any case, Dimon's bullish perspective resonates well with the recent comments by Larry Kudlow, executive director of the National Economic Council. Specifically, Kudlow advocates the optimistic outlook for the U.S. economy in light of both full employment and 3.5%-4% real GDP economic growth in mid-2018. Kudlow even emphasizes that the current U.S. economic boom may continue until 2022-2024.

Overall, these fundamental factors contribute to upbeat investor sentiments toward the current economic boom in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2024-03-19 03:35:58 Tuesday ET

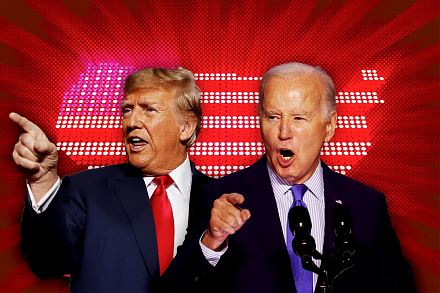

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2019-03-25 17:30:00 Monday ET

America seeks to advance the global energy dominance agenda by toppling Saudi Arabia as the top oil exporter by 2024. The International Energy Agency (IEA)

2018-02-03 07:42:00 Saturday ET

Quant Quake 2.0 shakes investor confidence with rampant stock market fears and doubts during the recent Fed Chair transition from Janet Yellen to Jerome Pow

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2018-01-02 12:39:00 Tuesday ET

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-1