2019-10-09 16:46:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form of gradual interest rate cuts, Chinese expansionary monetary policy decisions help stimulate domestic demand for consumption goods, services, and capital investments.

However, this monetary expansion may inevitably weaken the Chinese renminbi against the U.S. dollar and other core OECD currencies. This competitive currency devaluation renders Chinese exports more affordable. Meanwhile, this currency devaluation reduces global demand for more expensive Chinese imports. In the broader context of international trade, nevertheless, the recent empirical evidence shows that each 10% currency depreciation improves the trade balance by only 0.3% of real GDP economic output ceteris paribus. This evidence remains robust after the econometrician takes into account multi-year exchange rate fluctuations in response to interest rate cuts and other expansionary monetary policy decisions.

In light of these robust results, monetary expansion alone is unlikely to cause the large and persistent currency devaluation that the central bank needs to stimulate economic growth, employment, and capital accumulation. This economic insight further applies to the recent dovish interest rate cuts that the U.S. Federal Reserve institutes in response to a vocal president.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-25 12:33:00 Saturday ET

President Trump warns Google, Facebook, and Twitter that these tech titans now tread on troublesome territory. Specifically, Trump accuses Google of rigging

2019-03-07 12:39:00 Thursday ET

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa

2017-04-25 06:35:00 Tuesday ET

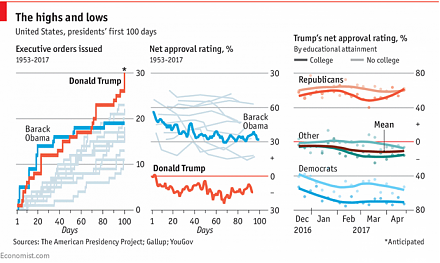

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2025-10-07 10:30:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-05 13:30:00 Monday ET

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 bil