2019-07-17 12:37:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider expanding additional monetary stimulus if the global economy continues to weaken in the next few months. Greenback depreciates quite a bit as the Federal Reserve switches to a dovish tone. The current stock market investor sentiments manifest in the negative correlation between U.S. dollar strength and gold appreciation. The precious metal accrues zero interest as a steady store of value over time, and so gold prices often serve as a negative-beta countercyclical indicator of international economic stability.

Meanwhile, the Sino-U.S. trade impasse calls for both Presidents Trump and Xi to show courage with some reconciliatory gestures at the G20 summit. Also, British Labour Party may seek to back a second referendum on Brexit despite pervasive economic policy uncertainty. British Conservatives now need a new prime minister to lead the next round of E.U. withdrawal conditions, trade negotiations, and other regional economic affairs. Moreover, the recent accidental drone collision between Iran and the U.S. adds to the current global trade escalation. As a result, both gold and oil prices surge as stock market investors seek capital safety.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-07-25 10:44:00 Tuesday ET

NerdWallet's new simulation suggests that a 25-year-old millennial who earns an inflation-free base salary of $40,456 and saves 15% each year faces a 99

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2025-10-12 13:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-12-07 08:31:00 Thursday ET

Large multinational tech firms such as Facebook, Apple, Microsoft, Google, and Amazon can benefit much from the G.O.P. tax reform. A recent stock research r

2023-07-21 10:30:00 Friday ET

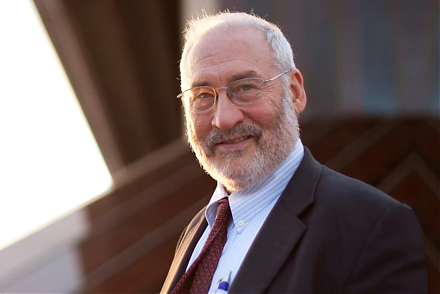

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi