2018-11-23 09:39:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Former White House chief economic advisor Gary Cohn points out that there is no instant cure for the Sino-U.S. trade dilemma. After the U.S. midterm elections, the major trade issues remain on the radar (as Republicans secure a stronger majority in Senate and Democrats flip the House of Representatives).

First, the U.S. bilateral trade deficit with China is about $300 billion, and President Trump seems to be uncomfortable with the key fact that this trade deficit is so large. Cohn disagrees with the presidential view because he alternatively views this trade deficit as $300 billion worth of goods that America can purchase from China in a cost-effective way. However, Cohn suggests that the Chinese administration can readily resolve this issue by buying more American goods to better balance Sino-U.S. trade.

Second, the more pertinent issue is the historically unfair situation that China often forces technology transfer when U.S. tech corporations enter the mainland market. Chinese regulations require foreign tech companies to build onshore data centers and IT research labs so that Sino-American technology transfer takes place. China thus fails to pay for foreign intellectual properties such as patents, trademarks, and copyrights etc. This core issue persists at the heart of the current Sino-U.S. trade impasse.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-09 08:31:00 Wednesday ET

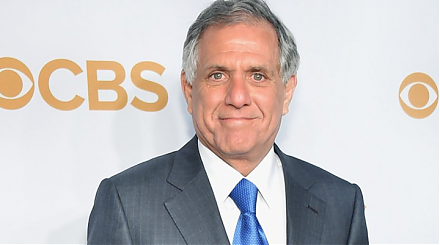

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2023-05-21 12:26:00 Sunday ET

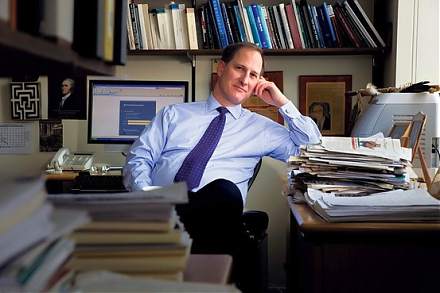

Amy Chua and Jed Rubenfeld suggest that relatively successful ethnic groups exhibit common cultural traits in America. Amy Chua and Jed Rubenfeld (2015)

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2019-12-19 14:43:00 Thursday ET

JPMorgan Chase CEO Jamie Dimon views wealth inequality as a major economic problem in America. Dimon now warns that the rich Americans have been getting wea

2020-09-15 08:38:00 Tuesday ET

Macro eigenvalue volatility helps predict some recent episodes of high economic policy uncertainty, recession risk, or rare events such as the recent rampan