2023-03-07 11:29:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Mervyn King (2017)

The end of alchemy: money, bank crisis, and the future of the global economy

As Former Bank of England Governor and Kennedy Scholar at Harvard University, Mervyn King offers his book The End of Alchemy as a substantive analysis of the Global Financial Crisis of 2008-2009. King discusses 4 main concepts that can knit together his narrative exposition of this important topic: disequilibrium, trust, radical uncertainty, and non-Pareto optimal equilibrium. By disequilibrium, King advocates that the global economic order has built substantial trade imbalances in the past 3 decades. Some countries have run substantial trade deficits, whereas, others have run trade surpluses. The quantity of high-skill labor demand typically cannot match the quantity of high-skill labor supply at the long prevalent labor market equilibrium wages and prices. This disequilibrium status quo often amplifies the negative ripple effects of the Global Financial Crisis of 2008-2009 through global supply chains.

By radical uncertainty, King refers to the subtle distinction between risk and radical uncertainty. Risk relates to the fact that key information cascades reveal the future through a known probability measure. Radical uncertainty pertains to the fact that the unknown future is unknowable ex ante. King suggests that radical uncertainty revolves around several macroeconomic events such as monetary (non)neutrality, asset market stabilization, and fiscal stimulus for both price stability and maximum sustainable employment etc. This notion relates to the classic Keynesian passage on animal spirits (alternatively, the self-fulfilling beliefs of asset market investors). Macroeconomic policymakers often need to assess the trade-off between inflation and unemployment in light of the optimal path of interest rate adjustments.

By non-Pareto optimal equilibrium, King refers to a usual macroeconomic outcome that is individually rational but not socially optimal. On the other hand, many macro economic policymakers often assess trade-offs and instruments in order to reduce social welfare costs of inflation, unemployment, and even asset market distortions. Transitional dynamic deviations from a Pareto optimum often lead to these welfare costs. Some macroeconomists view these welfare costs and market distortions as both unnecessary and preventable in the first place. Financial imbalances, crises, black swans, and gray rhinos etc often turn out to be the exceptions that prove the rules of thumb for both fiscal and monetary policy coordination. On balance, many macroeconomists often need a fair bit of strategic foresight to analyze short-term fiscal and monetary policy adjustments for reaching longer-term equilibrium steady states. King views this new notion of non-Pareto optimal equilibrium as an effective way of communicating deep economic insights to the general audience.

The final concept of trust suggests that we make rational choices on current beliefs about how others are likely to react in the future. King applies this concept of trust to discuss the main theories of money in light of substantive evidence both for and against monetary (non)neutrality. Money serves as both a common store of value as well as a conventional medium of exchange for most regular transactions. Trust further reflects the cultural perceptions of both fiat money creation and its profound implications for inflation as part of the dual mandate of both maximum sustainable employment and price stabilization.

King presents an interwoven set of 3 key themes. First, the global economic history provides both the description and evolution of public institutions from central bank independence to fiscal budget transparency. Second, several passages describe economic theories of fiat money, bank regulation, and macrofinancial stabilization. Third, King offers several prescriptions for what needs to be done for central banks and national treasuries worldwide to prevent the next global financial crisis. From a fundamental viewpoint, King draws an informative analogy of bank loan maturity transformation to alchemy in the book title. In this important way, King shares his substantive analysis of the root causes of the Global Financial Crisis of 2008-2009. In this analysis, King further shares several policy prescriptions for the prevention of future financial crises.

The narrative exposition by Mervyn King of the Global Financial Crisis 2008-2009 begins with the global trade imbalances due to the economic rise of China in recent decades. In reality, the micro collapse of the British building society Northern Rock in September 2007 precedes the subsequent failure of Lehman Brothers about a year later in America. As the Chinese economy grows at 8%+ per annum for almost 3 decades, most U.S. asset markets experience substantial foreign capital inflows that depress long-run real interest rates in North America. Through American mega banks and other financial institutions, these foreign capital flows contribute to large increases in the size of bank balance sheets.

At least 2 fundamental forces and factors cause financial fragility in the equilibrium between borrowers and lenders in America. This fragility would eventually lead to the Global Financial Crisis through massive subprime mortgage defaults. First, the gradual and persistent deregulation of both banks and financial markets emanates from the Chicago free market economic neoliberalism. Second, global institutional investors reach for higher yields in the fundamental sense that these investors tend to take greater risks to earn the same returns in the presence of consistent longer-term interest rate declines in recent decades. In combination, these 2 fundamental forces and factors contribute to the fragile financial market mechanism design for many derivative products such as subprime mortgage loans, credit default swaps, and asset securitizations etc. The resultant risk dislocation serves as the main root cause of the Global Financial Crisis of 2008-2009 as borrowers collectively default on subprime mortgage loans and other financial derivative products (such as credit default swaps and asset securitizations).

Both Bank of England and U.S. Federal Reserve System have become workforces of New Keynesian macro economists. These New Keynesians design and develop dynamic stochastic general equilibrium (DSGE) macro models to demystify trade-offs between inflation and unemployment in the dual mandate of both price stability and maximum sustainable employment. With his magisterial summary of business cycle theories, King views monetary (non)neutrality as a partial solution to the main problem of coping with radical uncertainty. In practice, the future is both unknown and unknowable. Thus, King suggests that the monetary theory of business cycles seems more realistic. As a key alternative paradigm, the real business cycle (RBC) model assumes most economic actors to make rational decisions on the solo basis of the often known probability distribution of future economic events. From the New Keynesian viewpoint, the RBC model shines little light on monetary non-neutrality and the optimal path of interest rate adjustments for better steady-state economic growth, employment, and physical capital accumulation. Under radical uncertainty, economic actors and investors make mistakes and judgments. With the benefit of hindsight, asset market beliefs change over time. It is difficult for macroeconomic policymakers to draw a clear distinction between rational beliefs and self-fulfilling prophecies in most asset markets.

King refrains from subscribing to the behavioral view that public policies often help correct irrational private mistakes. Specifically, King cannot lend credence to both behavioral finance and prospect theory in the recent publication of the best-sellers Animal Spirits by Nobel Laureates George Akerlof and Robert Shiller (2009), and Nudge by Nobel Laureate Richard Thaler and Law Professor Cass Sunstein (2009). King suggests that behavioral finance cannot confront the deeper question of what it means to be rational economic actors when the assumptions of most traditional utility optimization fail to hold in practice. Most economic actors neither make their own decisions on the basis of impulses, nor live in a utopian world of baseline utility optimization. If we cannot figure out how the world works, there is no unique right answer but only a problem of coping with the unknown future. For this reason, King believes that we need an alternative proposition to both rational utility optimization and behavioral finance.

King presents his alternative strategy as a syllogism in stark contrast to the rational risk paradigm. First, each rational decision maker (or economic actor) needs some categorization to classify problems into baseline utility optimization ones. Second, the decision maker needs a set of rules of thumb to make wise decisions when it is implausible to solve economic problems via individual utility optimization. Third, the decision maker needs some narrative exposition that integrates the important pieces of information in order to offer a sound basis for choosing the heuristic rules of thumb for each wise decision. This syllogism helps combine most macro models with New Keynesian DSGE elements in addition to behavioral finance. As a result, many considerations help economic policymakers make wiser and better decisions over time.

In accordance with the viewpoint of radical uncertainty, complex financial markets often amplify boom-bust fluctuations through the business cycle. King sees money as a fundamental way of dealing with the narrative exposition of capricious human behavior. In the absence of complete futures markets, individual traders turn to the market makers who offer the opportunity to transact immediately once buy-or-sell decisions have been taken. Many financial centers such as London and New York boast their deep and liquid markets. Investors can quickly sell their financial assets to obtain near-cash money with only small reductions in asset prices.

However, King regards asset liquidity as a short-term money illusion. In a capitalist economy, big banks and financial markets are private institutions that have evolved to provide a fundamental way of coping with the unpredictable unknown future. Big banks and financial markets collectively serve as the real-world substitutes for the economic concept of a grand auction. Money gives people the ability to exchange labor and capital today for greater intertemporal purchasing power in the unknown future. Specifically, fiat money (i.e. legal tender) not only serves as both a store of value and a medium of exchange, but also a major instrument for economic actors to deal with an uncertain future. Asset price gyrations occur because investors try to cope with the unknown future. Human judgments about future profits and prices can be highly unstable. This instability is fundamental to a capitalist economy. This in-depth discussion leads to the central question of the book The End of Alchemy by Mervyn King: how can policymakers design economic institutions that manage radical uncertainty well enough to avoid the human misery of the Great Depression of the 1930s, Great Stagflation of the 1970s, Global Financial Crisis 2008-2009, or the recent corona virus crisis 2020-2021?

Financial crises often pertain to the role of banks as private institutions that convert long-term illiquid investments into short-term liquid funds available on demand. In economic jargon, commercial banks engage in bank loan maturity transformation. This maturity transformation informs the prescient book title of The End of Alchemy. Like alchemists who attempted to transform base metals into gold, banks transform houses, machines, factories, and commercial properties etc with unknown or even questionable value into short-run purchasing power that most people accept as a medium of exchange.

Banks, deposit takers, and other lenders etc turn houses, machines, factories, and commercial properties into money by borrowing short-term funds and then lending those funds long-term. The liability side of a bank balance sheet consists of highly liquid checks and deposits that can serve transaction purposes. The asset side of a bank balance sheet consists of small cash reserves and substantial illiquid loans to households and companies. Often times these households and companies use mortgages or liens on other forms of property as collateral. By drawing checks and electronic transactions to transfer the ownership of bank liabilities, the bank turns most assets of unknown quality into money. This money enters many commercial banks in the form of bank reserves (or claims on the central bank). However, bank reserves cannot be sufficient to cover the intrinsic value of all loans to households and companies.

In a competitive financial sector, banks and other financial institutions compete for cash funds from depositors by paying interest on their accounts. In equilibrium, the mortgage interest from bank loans is just enough to cover the operational costs of running the bank. Most banks and other financial institutions strive to earn the time value of money through active loan maturity transformation. In effect, the bank loan maturity transformation creates new liquidity in the wider financial system. Liquidity creation serves as one of the reasons for the long prevalent high bank leverage in many modern economies. However, some recent Monte Carlo simulation analysis shows that most banks need to hold substantially greater equity capital buffers in order to safeguard against extreme losses in rare times of severe financial stress. This economic insight can be a powerful alternative argument for most banks and other financial institutions to increase their core equity capital requirements.

The financial system relies on mutual trust between borrowers and lenders. Insofar as both sides maintain trust, the financial system can be a highly effective market mechanism for anonymous trades to take place between people who may live in different regions. However, if the depositors ever lose trust in banks and most other financial institutions, the financial system is highly fragile and so can collapse like a house of cards.

The central bank often announces monetary policy rules to project the future path of interest rate adjustments in most normal circumstances. In accordance with the dual mandate of price stability and maximum sustainable employment, the central bank uses the Taylor interest rate rules in response to both inflation and the output gap from their target levels. The Taylor rules help minimize economic welfare costs in stark contrast to discretionary monetary policy decisions.

Former central bank chairmen Ben Bernanke and Mervyn King argue that central bankers must adapt their interest rate responses to uncertain economic events. In this fundamental sense, no response can be the correct one in every circumstance. King further suggests that central bankers must strategically cope with rare events (such as the Global Financial Crisis 2008-2009 and the corona virus crisis of 2020-2021). In this alternative view, no time-invariant rules can ever be as effective as the discretionary actions of smart central bankers. Most central banks often learn to apply clear and transparent forward guidance to calm institutional investors and other economic actors for better asset market stabilization. This strategic foresight can prove to be more realistic than simple baseline interest rate rules that rely on the technical calibration of theoretical welfare costs in dynamic stochastic general equilibrium (DSGE) macroeconomic models. When push comes to shove, the law of inadvertent consequences counsels caution.

With respect to bank regulation, the central bank serves as the lender of last resort. The central bank should make the general public aware in advance that the central bank would stand ready to lend in rare times of severe financial stress. The central bank should also lend at a penalty interest rate in order to force financial institutions to first exhaust all alternative sources of credit. Moreover, the central bank should lend on every kind of current security, or every sort of money as ordinary investors would lend in the form of bonds or many other loan contracts to receive reasonable returns on these bonds and loans.

Kind informs us that the American financial system has grown from 20% of annual GDP to more than 100% of annual GDP over the past century. We observe similar economic trends in Australia, Britain, France, Germany, Hong Kong, Japan, New Zealand, and Singapore etc. King attributes much of this financial sector growth to the gradual and consistent deregulation of the global financial system. Due to this financial deregulation worldwide, size has become a major performance target for many private bankers. These banks have become too big to fail in the presence of either explicit or implicit government guarantees for retail deposits such as deposit insurance and bank bailout etc. Banks borrow with private bonds in a cost-effective manner. This advantage allows these banks to offer cost-effective loans with lower interest rates and fees to many bank customers. From both Bank of America and Citigroup to JPMorgan Chase and Wells Fargo, several mega banks often expand more rapidly than their rivals and competitors in a virtuous circle of organic growth.

A solvent bank or other financial institution owns assets whose value exceeds the value of its liabilities. The difference between total assets and total liabilities is the equity capital requirement. When the bank is in financial distress, the equity capital holders are the first line of defense against bank failure. In a trenchant analysis of the Global Financial Crisis 2008-2009 and its aftermath, Admati and Hellwig (2014) persuasively call for banks to hold substantially higher equity capital buffers (such as 20%-30%) in order to safeguard against extreme losses in rare times of severe financial stress. When some bank fails due to insolvency, the bank failure not only affects the bank shareholders and depositors, but also can cause systemic ripple effects that arise from the nature of money as a public good. As some bank failure can spill over to cause deadweight losses elsewhere in the real economy, modern national governments often offer explicit or implicit guarantees to depositors in the event of bank failure. In light of the potential bank bailout in a financial crisis, banks have an incentive to make riskier loans. This moral hazard problem tends to prevail in modern financial markets.

Admati and Hellwig (2014) propose that banks must maintain an equity capital ratio of at least 25% (i.e. a minimum 25% ratio of tangible common equity to total assets). King urges the development of new bank capital regulation that he regards as the pawnbroker for all seasons. The essential problem with the conventional lender of last resort is that the only way for banks to provide sufficient liquidity in a crisis is to lend against bad collateral with inadequate haircuts and low penalty rates. In the crisis scenario, the central bank should announce in advance that most banks lend against good collateral at high haircuts and penalty rates. The discretion allows the central bank to consider flexible bailout arrangements once a crisis hits.

Central bank reserves would back deposits with cash-equivalent contingent claims (such as contingent convertible debt contracts). Also, most mega banks must pay up front the mandatory cost of liquidity provision. The financial institutions that can benefit from emergency liquidity provision would need to bear the cost in advance (perhaps in the form of deposit insurance or some other guarantee arrangement). The pawnbroker for all seasons therefore serves as a flexible version of new bank capital regulation. This regulation allows some discretion in the form of safe assets that represent good collateral even in a crisis mode.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-10-09 09:34:00 Monday ET

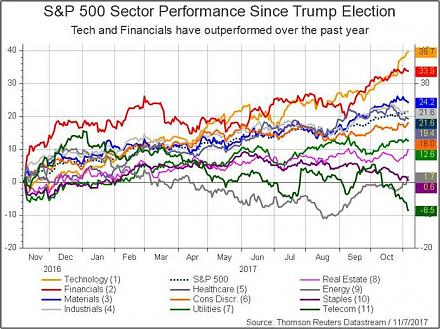

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2017-02-01 14:41:00 Wednesday ET

President Trump refreshes his public image through his presidential address to Congress with numerous ambitious economic policies in order to make America g

2022-02-25 00:00:00 Friday ET

Empirical tests of multi-factor models for asset return prediction The capital asset pricing model (CAPM) of Sharpe (1964), Lintner (1965), and Bla

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr

2018-12-18 10:38:00 Tuesday ET

President Trump threatens to shut down the U.S. government in 2019 if Democrats refuse to help approve $5 billion public finance for the southern border wal

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies