2018-12-22 14:38:00 Sat ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest rate hike that the U.S. economy seems sluggish in terms of real GDP per capita economic growth, employment, and capital investment. Some economic indicators such as household income and wage momentum soften in the current macro outlook.

Wall Street reacts negatively to the Powell comment about continuing to shrink the Federal Reserve balance sheet. Several stock market indices slump to the lowest levels in the fiscal year 2018. Dow Jones declines 352 points or 1.5%; S&P 500 also declines 1.5%; and NASDAQ plunges 2.3% as of mid-December 2018. This stock market pain extends to global markets: European and Asian stocks exhibit sharp losses around 3% on the next business day.

The Federal Reserve expects to ease the current interest rate hike with no more than 2 to 3 rate increases in 2019. Chairman Powell conveys his unusual dovish tone that the current interest rate hike reflects healthy fundamental recalibration in U.S. financial markets. This rate hike benefits most savers and traders who receive dividend and interest income from their stock and bond market investments.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-04-15 10:32:00 Friday ET

Corporate investment management This review of corporate investment literature focuses on some recent empirical studies of M&A, capital investm

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2019-03-09 12:43:00 Saturday ET

Pinterest files a $12 billion IPO due in mid-2019. This tech unicorn allows users to pin-and-browse images through its social media app and website. Pintere

2018-05-09 08:31:00 Wednesday ET

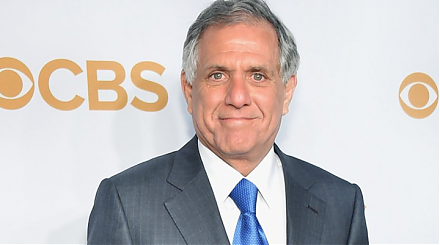

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2019-04-13 14:28:00 Saturday ET

Saudi Aramco unveils the financial secrets of the most profitable corporation in the world. In its recent public bond issuance prospectus, Aramco offers the

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones