2018-10-03 11:37:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly suggests that this positive outlook may be too good to be true. The U.S. economy operates near full employment with low inflation. The current U.S. unemployment rate is at the historically low level of 3.9%, and the inflation rate hovers around the Federal Reserve's medium-term target of 2%. These top-line statistics may not present an accurate picture of overall economic conditions, but a wide range of economic data on jobs and prices supports a positive view.

This combination not only serves well the Federal Reserve's dual mandate of both maximum employment and price stability, but also raises the reasonable question of whether real GDP economic growth is sustainable in the next few years. In light of high household consumption, capital investment, and credit supply expansion, the Federal Reserve expects real output growth to approach 3%+ until early-2020.

Low inflation and low unemployment arise as a rare combination in modern U.S. economic history. Whether this rare combination can sustain in the medium term remains an open controversy. With this ambivalence, U.S. economists, consumers, producers, and financial intermediaries remain in extraordinary times.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-23 11:34:00 Thursday ET

Harvard financial economist Alberto Cavallo empirically shows the recent *Amazon effect* that online retailers such as Amazon, Alibaba, and eBay etc use fas

2023-11-14 08:24:00 Tuesday ET

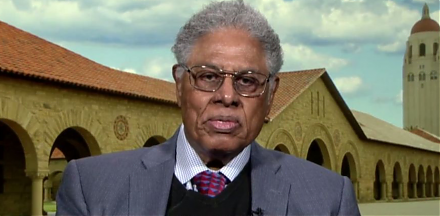

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2019-08-02 17:39:00 Friday ET

The Phillips curve becomes the Phillips cloud with no inexorable trade-off between inflation and unemployment. Stanford finance professor John Cochrane disa

2019-04-01 08:28:00 Monday ET

OraSure and its subsidiary DNA Genotek specialize in the lean production of home DNA spit tubes. OraSure extracts core genetic information from microbiome s

2017-03-15 08:46:00 Wednesday ET

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of