2019-11-09 16:38:00 Sat ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates that this effort can help sustain the current economic expansion without any form of prior quantitative easing (QE) asset purchase programs. As the Federal Reserve may start expanding its balance sheet again, stock investors must not misconstrue this decision as a tactical return to QE asset purchase programs in the post-crisis economic revival. This operation helps the Federal Reserve counterbalance some major economic headwinds such as domestic liquidity constraints and greenback fluctuations.

Powell indicates the generic inclination of FOMC members toward further reducing the interest rate in November-December 2019. Several stock market analysts and economic media commentators contend that the recent Powell remarks seem to accommodate both geopolitical risks and economic woes in response to a vocal president. In this light, many stock market analysts convey the grave concern that the Federal Reserve may have fewer policy instruments left for the next economic recession as the central bank continues to trade off monetary policy independence with political demand. After all, there are no good reasons for the sudden recent reversal of monetary policy normalization.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-01-03 09:34:00 Tuesday ET

USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved

2017-03-15 08:46:00 Wednesday ET

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio

2019-11-03 12:30:00 Sunday ET

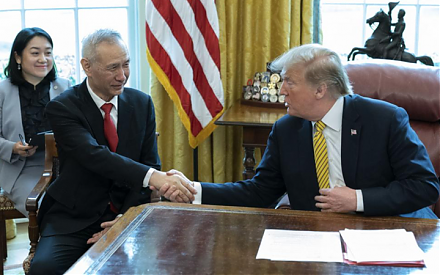

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2019-10-05 07:27:00 Saturday ET

Treasury Secretary Steven Mnuchin indicates that there is a good conceptual trade agreement between China and the U.S. in regard to intellectual property pr

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

2021-07-07 05:22:00 Wednesday ET

What are the best online stock market investment tools? Stock trading has seen an explosion since the start of the pandemic. As people lost their jobs an