2018-03-21 06:32:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Fed Chair Jerome Powell increases the neutral interest rate to a range of 1.5% to 1.75% in his debut post-FOMC press conference. The Federal Reserve raises the interest rate for the sixth time since the Federal Open Market Committee (FOMC) near-zero rate lift-off in December 2015. The Fed Chair transition from Yellen to Powell indicates a moderate monetary policy regime switch from dovish to hawkish in accordance with the recent FOMC minutes.

The Federal Reserve now targets a core PCE inflation rate above 2.1% as the U.S. unemployment rate gradually declines to the lowest level of 3.8%-4.1% in 17 years. Most dynamic stochastic general equilibrium (DSGE) New Keynesian economic models suggest that Powell has to trade off near-full employment with inflationary momentum. As inflation picks up over time, Powell must gradually raise the neutral interest rate to tame upward price gyrations when the U.S. economy operates near full employment.

Former Fed Chair Janet Yellen might prefer to keep the lower interest rate for a longer period of time, whereas, Powell departs from this lower-for-longer dovish and accommodative monetary policy stance in response to key FOMC hawks who express deep concerns about high inflation or price instability.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-03-09 05:32:00 Thursday ET

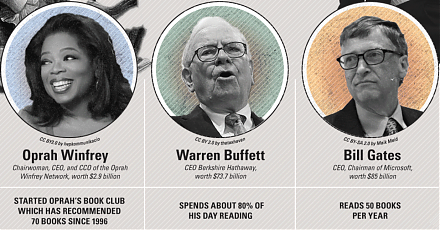

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2019-08-28 14:46:00 Wednesday ET

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen fin

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2019-10-05 07:27:00 Saturday ET

Treasury Secretary Steven Mnuchin indicates that there is a good conceptual trade agreement between China and the U.S. in regard to intellectual property pr

2019-01-15 13:35:00 Tuesday ET

Americans continue to keep their financial New Year resolutions. First, Americans should save more money. Everyone needs a budget to ensure that key paychec

2020-02-02 10:31:00 Sunday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement