2019-06-05 10:34:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Fed Chair Jay Powell suggests that the recent surge in U.S. business debt poses moderate risks to the economy. Many corporate treasuries now carry about 40% debt as part of equity market valuation. St Louis Federal Reserve Bank recent data indicate that the corporate-debt-to-EBITDA ratio has risen to the upper range of 2.3x to 3.1x.

Powell warns that the current level of business debt can cause financial stress to borrowers if the economy weakens. However, Powell adds the cautionary caveat that business debt may not present imminent risks to U.S. financial system stability, household consumption, and business growth. As the Federal Reserve continues to assess the main amplification of business debt deterioration, short-term liquidity risk remains moderate in the core U.S. financial sector. In the meantime, the Trump administration seeks to raise fiscal deficits to support ambitious public programs on infrastructure, education, residential estate, health care, and social security etc. This public debt accumulation may crowd out intertemporal business debt capacity at the margin. If the U.S. aggregate debt capacity remains invariant over time, the government either has to tolerate higher inflation in the form of seigniorage taxes, or needs to reconsider the ripple effects of incremental corporate debt on the real economy.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-17 07:41:00 Thursday ET

Has America become a democratic free land of crumbling infrastructure, galloping income inequality, bitter political polarization, and dysfunctional governa

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2017-12-19 09:39:00 Tuesday ET

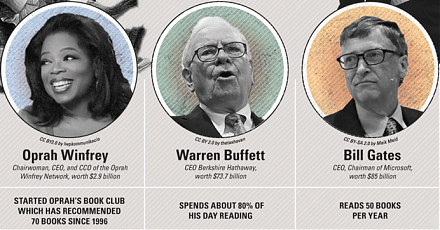

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs: