2017-12-11 08:42:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to the economy and the macroprudential system. During her final Federal Reserve press conference, Yellen says the prime metrics such as the forward aggregate stock market P/E and P/B ratios are on the high end of historical ranges when the Fed warns that asset prices appear to be high. In fact, the low-interest-rate economic environment is supportive of higher stock prices and home prices. In this context, there is a reasonable balance of financial risks that manifest in the form of less worrisome levels of both bank leverage and private credit growth.

A recent Project Syndicate op-ed article sketches the key reasons for U.S. stock market rational exuberance such as better economic growth with low inflation, monetary and fiscal stimulus, full employment, and higher net income in both the household and corporate sectors. As the world economy skyrockets on all cylinders in America, Europe, and China with robust economic growth since the global financial crisis of 2008-2009, U.S. inflation remains below the 2% target, unemployment is less than 5%, and monetary policy normalization continues at a moderate pace. Federal Reserve shrinks its balance sheet post-QE, finishes the full course of 3 interest rate hikes in 2017, and then expects another around of 3 to 4 rate increases in 2018. The current 7-year uptick in U.S. corporate net income typically precedes the European and Asian counterparts in subsequent episodes. All of these reasons help justify the current Trump stock market rally as rational exuberance and optimism.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-17 12:40:00 Monday ET

Nobel Laureate Robert Shiller's long-term stock market indicator points to a recent peak. His cyclically-adjusted P/E ratio (or CAPE) accounts for long-

2018-09-07 07:33:00 Friday ET

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past deca

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2023-09-28 08:26:00 Thursday ET

Daron Acemoglu and James Robinson show a constant economic tussle between society and the state in the hot pursuit of liberty. Daron Acemoglu and James R

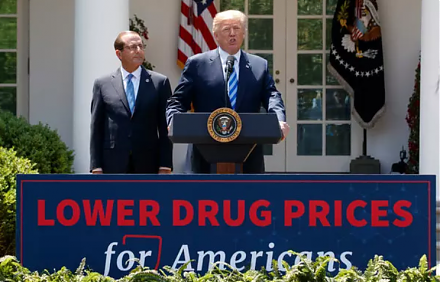

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2022-11-25 09:29:00 Friday ET

Uniform field theory of corporate finance While the agency and precautionary-motive stories are complementary, these stories can be nested as special cas