2019-08-12 07:30:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (FTC) probes into prevalent user privacy practices across the social media ecosystem of Facebook, Messenger, Instagram, and WhatsApp etc. FTC commissioners break along party lines, 3-to-2, as the GOP majority votes line up to support the $5 billion settlement (whereas Democratic commissioners object this pact). This punitive fine is the single largest one against a tech titan by FTC to date, but some progressive lawmakers remain furious primarily due to the key controversial inadequacy of FTC curtailing future data leaks and breaches of the same sort of Cambridge Analytica.

The Cambridge Analytica data debacle may have compromised the personal data for about 87 million Facebook users. FTC requires Facebook to establish a new independent Privacy Committee of directors on the current corporate board. This committee would oversee all necessary audit functions to ensure strict compliance with key FTC consumer privacy rules and best practices. With 53% majority control rights, Facebook CEO Mark Zuckerberg may inadvertently be able to influence the nomination and appointment of independent directors on the Privacy Committee. This core settlement can cause ripple effects on the broader corporate governance structure.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o

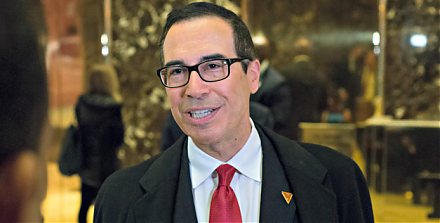

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)

2019-08-12 07:30:00 Monday ET

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (F