2019-08-12 07:30:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (FTC) probes into prevalent user privacy practices across the social media ecosystem of Facebook, Messenger, Instagram, and WhatsApp etc. FTC commissioners break along party lines, 3-to-2, as the GOP majority votes line up to support the $5 billion settlement (whereas Democratic commissioners object this pact). This punitive fine is the single largest one against a tech titan by FTC to date, but some progressive lawmakers remain furious primarily due to the key controversial inadequacy of FTC curtailing future data leaks and breaches of the same sort of Cambridge Analytica.

The Cambridge Analytica data debacle may have compromised the personal data for about 87 million Facebook users. FTC requires Facebook to establish a new independent Privacy Committee of directors on the current corporate board. This committee would oversee all necessary audit functions to ensure strict compliance with key FTC consumer privacy rules and best practices. With 53% majority control rights, Facebook CEO Mark Zuckerberg may inadvertently be able to influence the nomination and appointment of independent directors on the Privacy Committee. This core settlement can cause ripple effects on the broader corporate governance structure.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2022-11-25 09:29:00 Friday ET

Uniform field theory of corporate finance While the agency and precautionary-motive stories are complementary, these stories can be nested as special cas

2025-06-21 10:25:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why emotional intelligence can serve as a more important critical succ

2019-08-31 14:39:00 Saturday ET

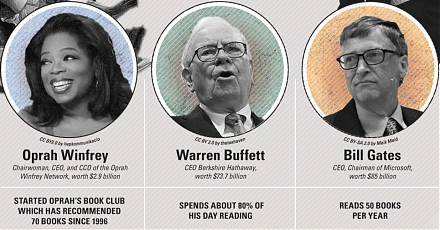

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2018-01-29 07:38:00 Monday ET

President Donald Trump delivers his first state-of-the-union address. Several key highlights touch on economic issues from fiscal stimulus and trade protect

2019-10-07 12:35:00 Monday ET

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Res