2019-07-21 09:37:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Facebook introduces a new cryptocurrency Libra as a fresh medium of exchange for e-commerce. Libra will be available to all the 2 billion active users on Facebook, Messenger, Instagram, and WhatsApp. This new cryptocurrency has tremendous potential to change how people save, spend, and send money. As a new medium of exchange, Libra helps facilitate key e-commerce auctions and other transactions within the core Facebook social network ecosystem. As a new store of value, Libra exhibits less extreme price volatility than several other cryptocurrencies such as Bitcoin and Ethereum.

Facebook launches the digital wallet company Calibra as a key third-party payment gateway in collaboration with PayPal, Stripe, Visa, MasterCard, American Express, eBay, Spotify, Uber, and Lyft etc. At inception, Calibra records all the Libra digital transactions on a public blockchain. This blockchain can serve as a tamper-proof ledger that runs across multiple computer servers to preserve consumer privacy. When cryptocurrencies become more popular, money supply growth may decline to the extent that the central bank can better curb price inflation and wage growth in a cashless society.

In terms of macroeconomic implications, the central bank and fiscal authority can better manage the trade-offs among price stability, economic growth, employment, capital accumulation, and financial market stabilization.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2019-07-07 18:36:00 Sunday ET

The Chinese central bank has to circumvent offshore imports-driven inflation due to Renminbi currency misalignment. Even though China keeps substantial fore

2017-04-25 06:35:00 Tuesday ET

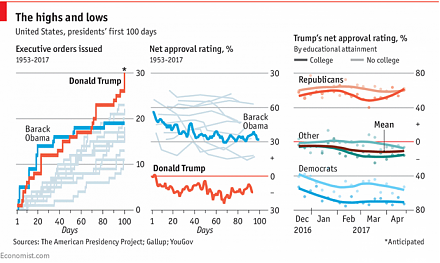

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

2019-09-19 15:30:00 Thursday ET

U.S. yield curve inversion can be a sign but not a root cause of the next economic recession. Treasury yield curve inversion helps predict each of the U.S.

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati