2018-06-06 09:39:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bilateral peace summit, Trump indicates a terrific bilateral relationship in the way forward and thus expects the summit to be a tremendous success. Kim admits numerous obstacles that both sides had to overcome in order to get to this historic moment.

U.S. State Secretary Mike Pompeo, nevertheless, warns that American economic sanctions will remain in effect until North Korea completely denuclearizes its major arsenals. Many senior U.S. foreign-policy technocrats emphasize that North Korea has yet to attain complete, verifiable, and irreversible denuclearization (CVID).

Former NBA star Dennis Rodman contributes to *basketball diplomacy*, bursts into tears in a CNN live interview about the summit, and wishes the best for the future peace and prosperity of both countries. The world's major stock indices rise in response to the historic peace summit between Trump and Kim.

Due to a substantial reduction in geopolitical risk, the recent tripartite peace talks among America, North Korea, and South Korea help alleviate investor concerns and sentiments about international economic policy uncertainty.

The Korean peninsula has been a major flashpoint in East Asia since the Korean War took place 65 years ago. During the new peace summit, Trump and Kim have signed a comprehensive denuclearization agreement in order to free North Korea from draconian U.N. economic sanctions. U.S. and most East Asian stock markets enjoy healthy gains due to sound and steady U.S.-Korean relations in recent times.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2023-10-28 12:29:00 Saturday ET

Paul Morland suggests that demographic changes lead to modern economic growth in the current world. Paul Morland (2019) The human tide: how

2018-01-08 10:37:00 Monday ET

Spotify considers directly selling its shares to the retail public with no underwriter involvement. The music-streaming company plans a direct list on NYSE

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2018-06-05 07:36:00 Tuesday ET

Just Capital issues a new report in support of the stakeholder value proposition in recent times. U.S. corporations that perform best on key priorities such

2017-10-21 08:45:00 Saturday ET

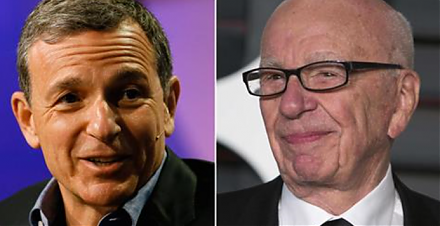

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.