2018-09-05 08:34:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestrated taking Tesla private to burn investors. This lawsuit alleges that Musk might have inadvertently engaged in stock price manipulation via his premature tweet. Musk may prefer Tesla to go private such that he can steer business decisions without worrying about near-term share price gyrations.

However, taking Tesla private entails large lump-sums of equity funds from outside venture capitalists. This lawsuit sheds skeptical light on whether Musk's premature tweet on funding Tesla to go private should be subject to S.E.C. regulatory scrutiny.

Short-sellers serve as an effective alternative corporate governance mechanism that helps discipline corporate management in major business decisions. Not only do short-sellers pose a major effective threat to incumbent entrenchment and rent protection, but they can also improve stock price efficiency and information content. Short-sellers short shares at artificially high prices, wait a while for negative news about the company, and then buy back these shares at lower prices to earn short-term gains.

The Citron lawsuit against Tesla and Elon Musk represents a classic example of fraudulent stock price manipulation that proves to be detrimental to short-sellers.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost

2019-11-06 12:29:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2019-08-09 18:35:00 Friday ET

Nobel Laureate Joseph Stiglitz maintains that globalization only works for a few elite groups; whereas, the government should now reassert itself in terms o

2025-06-20 08:27:00 Friday ET

President Trump poses new threats to Fed Chair monetary policy independence again. We describe, discuss, and delve into the mainstream reasons, conc

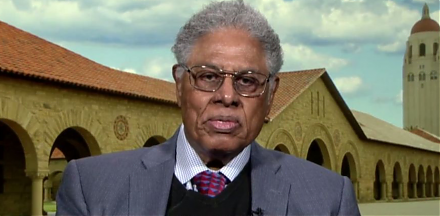

2023-11-14 08:24:00 Tuesday ET

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo