2019-08-05 13:30:00 Mon ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 billion to $1.12 trillion. These Treasury bond positions reach their lowest level or 5% of U.S. government debt in 2017-2019 amid Sino-American trade conflict and economic policy uncertainty. The Chinese Xi administration may use its current status as the top Treasury debtholder as special leverage in the next round of trade negotiations. In response, the Chinese renminbi hovers in the broad range of 6.69x-6.97x per U.S. dollar during the recent time frame. Some investment bankers speculate that as the largest foreign owner of U.S. government bonds, China may implement the nuclear option by offloading lots of Treasury bonds to trigger interest rate hikes in America. These interest rate hikes may inadvertently cause collateral damage to the U.S. economy.

However, Lowy Institute senior fellow Richard McGregor offers the fresh economic insight that China cannot easily manipulate its current U.S. Treasury bond portfolio with no negative impact on the Chinese currency and current account deficit. U.S. trade envoy Robert Lighthizer and Treasury Secretary Steven Mnuchin expect to meet the Chinese hardliners for bilateral trade discussions in Shanghai from late-July to mid-August 2019.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare

2019-09-23 12:25:00 Monday ET

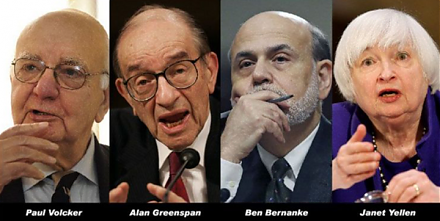

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2017-01-03 03:26:00 Tuesday ET

President-Elect Donald Trump wants Apple and its tech peers to consider better and greater high-tech job creation in America. Apple has asked its primary

2018-07-19 18:38:00 Thursday ET

Goldman Sachs chief economist Jan Hatzius proposes designing a new Financial Conditions Index (FCI) to be a weighted-average of interest rates, exchange rat

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2023-10-07 10:24:00 Saturday ET

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects. Thomas Philippon (20