2022-11-05 11:32:00 Sat ET

mergers acquisitions corporate finance baker and wurgler managerial entrenchment jarrad harford corporate governance corporate investment corporate social responsibility rent protection ceo overconfidence board connections capital expenditures david hirshleifer ronald masulis andrei shelifer lucian bebchuk ulrike malmendier

Malmendier and Tate (JFE 2008, JF 2005) argue that overconfident CEOs are more likely to initiate mergers and acquisitions that erode shareholder value. The odds of initiating mergers and acquisitions increase by 65% if the CEO is viewed as overconfident in terms of late option exercise (Longholder and Holder 67) or press portrayal. The effect of CEO overconfidence on M&A likelihood is more pronounced if the deal involves firm diversification and does not require external finance. CEO overconfidence tends to drive M&A and capital overinvestments to the detriment of outside shareholders (Jensen, AER 1986; Stulz, JFE 1990; Lang, Stulz, and Walkling, JFE 1991; Harford, JF 1999). The 3-day cumulative abnormal return is significantly more negative for acquirers with overconfident CEOs (–90 basis points) than for acquirers with non-overconfident CEOs (–12 basis points). The negative impact of CEO overconfidence on bidder returns complements the behavioral hypothesis that CEO overconfidence complicates corporate investment distortions (Malmendier and Tate, JF 2005). CEO overconfidence significantly correlates with a greater cash flow sensitivity of capital investment, especially among equity-dependent firms. These results reflect the dark side of CEO overconfidence on M&A and capital overinvestments.

In terms of its dark side, CEO overconfidence complicates corporate investment distortions (Malmendier and Tate, JF 2005, JFE 2008; Ben-David, Graham, and Harvey, QJE 2013), financial fraud and earnings management (Schrand and Zechman, JAE 2012), and financial misstatement (Hribar and Yang, CAR 2015). Malmendier, Tate, and Yan (JF 2011) empirically find that prior life experiences such as military service and adulthood in the Great Depression affect the relative degree of CEO overconfidence. CEOs with a military background tend to maintain high leverage while CEOs with some Great Depression experience tend to use debt conservatively relative to the other CEOs. Overall, overconfident CEOs seem to follow the pecking order and so prefer to first use up internal finance and available debt capacity before their firms tap into external equity. Ben-David, Graham, and Harvey (QJE 2013) find that overconfident CEOs make suboptimal investment decisions because these CEOs have miscalibrated conditional expectations of stock return distributions.

In this context, a major puzzle arises from why firms employ overconfident CEOs in the first place. Hirshleifer, Low, and Teoh (JFE 2012) suggest the bright-side story that overconfident CEOs are better R&D innovators. Firms with overconfident CEOs invest more in R&D innovation, yield more patents and patent citations, and achieve greater innovative efficiency per unit of R&D expenditure. The empirical corporate finance literature is replete with examples in support of both the bright and dark sides of CEO overconfidence.

Cai and Sevilir (JFE 2012) find that both first-degree and second-degree board connections significantly correlate with positive 5-day abnormal bidder returns (2.45% and 1.84%). First-degree board connections help enhance the information flow and communication between the bidder and target firms. Second-degree board connections lead to an improvement in industry-adjusted ROA of about 2% in the post-merger period. In comparison to Cai and Sevilir's study of the effect of professional connections on M&A bidder returns, Ishii and Xuan (JFE 2014) study the effect of social ties through school or prior employment on M&A bidder returns. Because better social ties correlate with a high probability that the target-firm executive directors and managers remain in their respective positions post-announcement, the market reacts negatively to the presence of these social ties. The bidder-firm incumbents tend to receive hefty bonuses or some other cash windfalls for completing M&A deals through their social ties with the target-firm executive directors and managers. These empirical studies provide complementary evidence in light of the different effects of professional connections versus social ties on M&A bidder returns.

Deng, Kang, and Low (JFE 2013) apply 2SLS regressions to address the potential endogeneity of bidder CSR performance and merger performance. The religion rank of the state of the bidder's headquarters, and the blue-state dummy variable, serve as relevant and exclusive instrumental variables for these 2SLS regressions. These instruments correlate with the bidder's CSR engagement but not the merger outcome variables such as bidder stock return performance and merger default likelihood. The use of several control variables for product market competition, corporate governance, and managerial compensation accords with the prior corporate finance literature (e.g. Masulis, Wang, and Xie (JF 2007); Edmans, Gabaix, and Landier (RFS 2009); Harford, Humphery-Jenner, and Powell (JFE 2012)). High-CSR bidders yield higher abnormal bidder returns around deal announcements, higher bidder-target portfolio returns around deal announcements, and greater increases in long-run operating performance post-announcement. The bidder's CSR performance is a major positive determinant of both bidder stock return performance and merger success likelihood.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

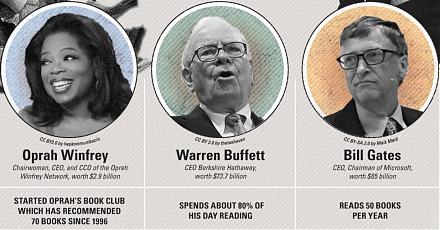

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2019-11-21 11:34:00 Thursday ET

Berkeley macro economist Brad DeLong sees no good reasons for an imminent economic recession with mass unemployment and even depression. The current U.S. ec

2019-01-03 10:38:00 Thursday ET

American parents often worry about money and upward mobility for their children. A recent New York Times survey suggests that nowadays American parents spen

2020-11-17 08:27:00 Tuesday ET

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation. Alan Weiss (2016)

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O