2020-09-10 08:31:00 Thu ET

lean startup distinctive capabilities value creation proprietary assets leadership competitive advantages team leaders iterative continuous improvements culture changes perseverance resilience agility senior managers core business operations execution disruptive innovation business model dual transformation purpose vision mission strategic solutions strategic solutions tactical solutions tactical solutions blue ocean

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability.

Todd Zenger (2016)

Beyond competitive advantage: how to solve the puzzle of sustaining growth while creating value

In order to achieve long-term success and sustainable profitability, most business organizations must continuously create value to meet new customer demands. In practice, the primary purpose of corporate strategies requires empowering the lean enterprise to find a clear path to new value creation with both unique propositions and competitive advantages over time. These corporate strategies shine fresh light on new value creation by revealing both valuable problems and solutions in sales, purchases, and lean production lines etc. In due course, these effective corporate strategies help define how the agile lean enterprise can apply its unique resources, proprietary assets, noble causes, social missions, rare resources, and distinctive capabilities in a pivotal way that most competitors cannot. Further, these corporate strategies help identify the particular types of business opportunities that the agile lean enterprise can pursue in order to complement its key extant proprietary assets with fresh positive synergies. On balance, most effective corporate strategies help empower the agile lean enterprise to grow fast over time with positive changes and even disruptive innovations by encouraging the exploration and domination of new blue-ocean markets. Humble servant-leadership, good strong will, perseverance, lean startup design, and iterative continuous improvements become essential and important in the broader business context.

Most agile lean enterprises often continue to achieve new and different competitive advantages over time to sustain corporate value creation.

The foundational competitive advantage logic requires the agile lean enterprise to defend its unique market dominance. The unique market dominance provides most customers with greater value amid fierce competition. The competitive advantage strategy can lead to high profitability, but this traditional strategy cannot guarantee sustainable value creation. In fact, many public corporations attain high net profits, but their stock prices remain subpar and sluggish because investors only reward the achievement of unique valuable market dominance once. To boost share price growth over time, the agile lean enterprise engages in sustainable value creation, which requires the development and accumulation of new and different competitive moats and first-mover advantages over time.

Both business leaders, senior managers, and their key team members apply some specific effective corporate strategies to make productive use of proprietary assets, capital investments, and other rare and valuable resources. These rare assets and resources collectively create value for the agile lean enterprise. In essence, these corporate strategies anticipate how customer demands, technological advances, and industry trends evolve over time. Both business leaders and senior managers must apply strategic foresight to carry out these corporate strategies in due course. All relevant team members apply actionable business insights into the best use of both proprietary assets and rare resources to make the most of strategic foresight from senior management. These actionable business insights must clarify the fact that specific external assets, forces, conditions, or circumstances can complement the extant proprietary assets with synergistic value creation. On balance, effective corporate strategies reflect the core competences, distinctive capabilities, and rare resources etc of the agile lean enterprise in comparison to its rivals. For instance, Disney implements the unique corporate strategy that the company can attain both ubiquitous consumer appeal and sustainable value creation by continually creating new characters and animations in fantasy worlds through multimedia channels and complementary entertainment assets such as dolls, toys, action figures, and theme parks. Through the strategic acquisition of the computer animation company Pixar, Disney continues to apply the foundational elements of its long-run business vision. From the mid-1980s to 2020, Disney has substantially increased its stock market capitalization from $1.8 billion to more than $200 billion.

Due to their high-skill subject matter expertise, strategic business leaders are more effective at building action plans for sustainable value creation than most investors. These strategic leaders or business builders often need to convince shareholders that their effective corporate strategies can contribute substantially to sustainable value creation in the long run. It is difficult for these business builders to convince shareholders due to the lemons problem of adverse selection. Since both business leaders and senior managers retain pivotal information that shareholders cannot, it is hard for shareholders to assess whether strategic leaders truly retain prescient and actionable business insights to carry out effective corporate strategies for long-run sustainable value creation (or lemons like subpar second-hand cars).

When strategic leaders or business builders want to retain control and then attempt to overcome the perennial lemons problem, these strategic leaders often need to communicate their powerful descriptions of corporate strategies. These corporate strategies should accord with the long-term business vision and sustainable value creation. For example, Facebook strives to connect social media users worldwide through its strategic acquisitions of Instagram, WhatsApp, and Oculus etc. When Apple applies iterative continuous improvements in iPhone logistic production, the mobile device producer offers at least 3 smart phone models to reach different tiers of users. With continuous iOS software service upgrades, this multi-model product provision enhances global mobile connectivity for most early technology adopters and other iPhone lovers from year to year. In a similar vein, Amazon first succeeds in e-commerce and then provides premier cloud services to many small-to-medium enterprises, and Microsoft continues to improve its landmark Windows operating system, Edge web browser, and Office software suite for every PC user worldwide. Amid fierce competition and antitrust economic policy uncertainty, these tech titans ameliorate the lemons problem as the strategic leaders communicate their longer-term business visions and purposes to the respective investors. Sometimes these business builders refrain from providing their competitors with valuable tech details. This concern reinforces the main theme that the most business organizations often need to develop new and different competitive moats and first-mover advantages for longer-term sustainable value creation.

Most agile lean enterprises often need to ensure the seamless integration of both proprietary asset ownership and institutional knowledge for new value creation.

The agile lean enterprise often needs to evaluate the trade-off between proprietary asset ownership and external resource acquisition. It is essential and important for the agile lean enterprise to develop its own internal proprietary assets to drive core business operations. From time to time, these core business operations generate most sales and profits for the business organization. Also, the agile lean enterprise has to outsource some non-core business operations to external third-party service providers. Both business leaders and senior managers can promote the seamless integration of both internal asset ownership and external resource acquisition. This integration strategy grants the agile lean enterprise complete control over the core proprietary assets and business operations. This internal control mechanism thus makes it easier for all business partners to share institutional knowledge. Over time, the agile lean enterprise institutes the dual transformation to bring in some of those external resources to perform some non-core business operations. In due course, the latter become part of the core proprietary assets and business operations with steady cash flows and income streams. In other words, most corporate strategies help transform real growth options into new proprietary assets that help secure net cash income streams. All core team members contribute to this dual transformation as a virtuous positive feedback loop of iterative continuous improvements. From a fundamental perspective, this transformative integration of both internal proprietary assets and external rare resources often contributes to long-term sustainable value creation. Through the arduous business journey, the agile lean enterprise develops new and different competitive moats and first-mover advantages in order to further reinforce long-run new customer value creation.

Most agile lean enterprises often focus on the dynamic design of both central and flat business processes and organizations for new customer value creation.

Because both business builders or strategic leaders want the agile lean enterprise to simultaneously pursue many positive net-present-value projects, these leaders often attempt to focus on the dynamic design of both central and flat core business processes and organizations for new customer value creation. Strategic leaders or business builders thus adapt their dynamic design of both central and flat parts of major proprietary operations to customer demands and external forces, conditions, and circumstances. Examples of good high-skill strategic business leaders include Walt Disney, Michael Eisner, Steve Jobs, Tim Cook, Bill Gates, and Satya Nadella. These high-skill strategic business leaders pull together many internal team work streams to alleviate the widespread concerns such as brain overload, knowledge worker morale and motivation, and behavioral time inconsistency. One size cannot fit all, and a few tactical solutions can cause inadvertent consequences to snowball into bigger problems in the long run. For this reason, multiple considerations often come into play when both business leaders and senior managers design near-term tactical solutions and longer-run corporate strategies for sustainable value creation. Sometimes business leaders and decision-makers strive to combine both product differentiation and service innovation with sustainable cost management to attain competitive moats and first-mover advantages.

Both business leaders and senior managers first identify flaws and problems and then design suitable strategic solutions in response to most medium-term concerns. Effective corporate strategies and solutions help address these common concerns. Sometimes most business leaders come to the realization that it can be quite hard to eradicate chronic perennial problems. In the worst-case scenario, both business leaders and senior managers often need to develop tactical solutions to minimize the risk that the near-term problems may inadvertently snowball into bigger future crises. When push comes to shove, it would be better for business leaders to strive to cure the disease without killing the patient. From time to time, strategic business leaders and senior managers must communicate their noble causes and missions in order to win the approval of majority shareholders. Charismatic business leaders often use clear and powerful language to empower all relevant team members and other stakeholders to comprehend the respective bold visions of sustainable value creation. In this important way, both business leaders and senior managers aim to pull together team efforts and projects to help enrich the day-to-day lives of others.

Visionary business leaders own the corporate statement of purpose and so accept responsibility for this key statement. Apple strives to challenge the status quo with great mobile devices such as iPhones and iPads. Facebook tries to connect people to make the world become better and safer with greater social mobile movements. Microsoft designs and refines software suites for every PC user. Amazon attempts to facilitate online sales, mobile payments, and cloud services for individual buyers, third-party sellers, and small-to-medium enterprises etc. Google tries to monetize Internet search and cloud software to bring information to global users at the click of a button. Tesla applies lean methods to produce electric cars with better features for auto lovers. SpaceX collaborates with NASA and U.S. Defense Department to send astronauts to the International Space Station with new scientific experiments from month to month. All these successful business organizations learn from major mistakes, errors, and even epic failures etc before these companies can carve out a fantastic future for their users, customers, and most other stakeholders. Humble servant-leadership, good and strong will, perseverance, lean design, and iterative continuous improvements become essential and important in the broader business context.

Both business leaders and senior managers should provide their teams, divisions, and executive committees etc with clear work priorities and guidelines. There can be several creative ways for team members to skin a cat, and all roads eventually lead to Rome. It is quite common for strategic leaders to choose the corporate path of least resistance to sustainable value creation. At any rate, both business leaders and senior managers coordinate, integrate, and so transform team efforts, projects, and actions to take advantage of most optimal corporate strategies, solutions, and opportunities. For most strategic business leaders, the ultimate goal requires team efforts to focus on the privy transformation of both passion and intellectual curiosity into pragmatic actionable business insights for long-run sustainable value creation. Small wins, major milestones, and many other iterative continuous improvements help move the corporate flywheel by revealing new and different competitive moats and first-mover advantages along the arduous business journey.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2019-11-06 12:29:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2017-10-09 09:34:00 Monday ET

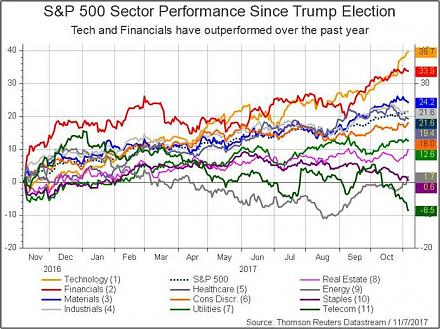

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2019-12-25 19:46:00 Wednesday ET

Former White House chief economic advisor Nouriel Roubini discusses the major limits of central-bank-driven fiscal deficits. The International Monetary Fund

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to