2019-10-11 13:40:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era. As a native Alabaman son of a shipyard worker and a pharmacy employee, nonetheless, Cook keeps his low-key life habits and hobbies. His public personal wealth comes from $622 million Apple shares and $3 million stock options in Nike (as Cook now serves on its board of directors). Like his predecessor Steve Jobs and other tech founders from Jeff Bezos and Bill Gates to Larry Page and Mark Zuckerberg, Cook focuses his attention and energy on technological advancement and legacy innovation.

Cook leads a frugal solitary life, buys clothes-and-shoes at the Nordstrom semi-annual sale, and lives in a relatively modest $1.9 million home in Palo Alto (in stark contrast to the median home price of $3.5+ million in the San Francisco Bay Area). Money cannot motivate Tim Cook because he spends most time trying to find the next disruptive innovation that revolutionizes the market for smart mobile devices. Cook serves as a wise tech trailblazer in product diversification as he pioneers the post-Jobs trifecta of iPhone Xs, iPhone Xs Max, and iPhone XR.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-04 11:41:00 Friday ET

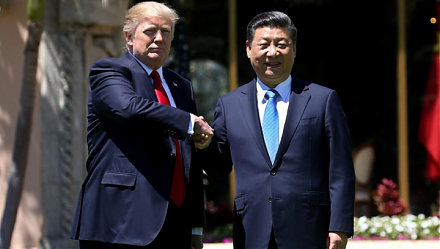

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2017-02-07 07:47:00 Tuesday ET

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2018-03-27 07:33:00 Tuesday ET

CNBC's business anchorwoman Becky Quick interviews Nobel Laureate Joseph Stiglitz on the current trade war between America and China. As America imposes