2018-12-11 10:34:06 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stanford to the Asia Society Center on U.S.-China Relations, these specialists contribute to the collective wisdom of a comprehensive report on new U.S. precautions against Chinese efforts that might undermine democratic values. In promoting constructive vigilance to better balance Sino-American influences and interests, these pundits and experts urge U.S. government agencies, public organizations, think tanks, and other institutions to adopt more aggressive measures in order to prevent the risk of economic espionage by China.

The Chinese communist party-state now leverages a broad variety of party, state, and non-state agencies to advance its economic interests and influences. In recent years, the Xi administration has significantly accelerated its investments in critical tech inventions from Internet search and e-commerce to social media and artificial intelligence etc. China often uses its domestic companies to gain access to foreign critical infrastructure and technology.

The Xi administration has made U.S. corporate access to its massive mainland market almost conditional on strict compliance with mainland regulations that favor both domestic employment and technological diffusion. This strategic issue calls for serious socioeconomic consideration in light of the interim 90-day trade truce between China and America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-05 08:25:00 Friday ET

Warren Buffett places his $58 billion stock bets on Apple, American Express, and Goldman Sachs. Berkshire Hathaway owns $18 billion equity stakes in America

2019-04-26 09:33:00 Friday ET

JPMorgan Chase CEO Jamie Dimon defends capitalism in his recent annual letter to shareholders. As Dimon explains here, socialism inevitably produces stagnat

2018-08-29 10:37:00 Wednesday ET

In an exclusive interview with Bloomberg, President Trump criticizes the World Trade Organization (WTO), proposes indexing capital gains taxes to inflation

2018-11-11 13:42:00 Sunday ET

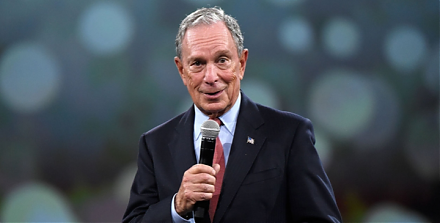

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2018-07-27 10:35:00 Friday ET

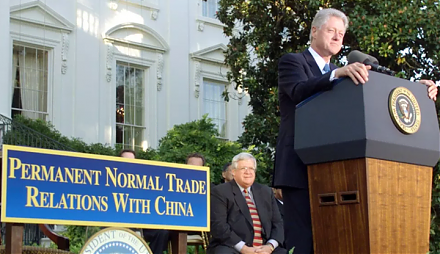

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th