2019-11-07 14:36:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

America expects to impose punitive tariffs on $7.5 billion European exports due to the recent WTO rule violation of illegal plane subsidies. World Trade Organization rules that America can impose 25% tariffs on $7.5 billion European goods such as coffee, wine, whisky, cheese, and so forth in retaliation for illegal subsidies for the European airplane-maker Airbus. This decision may spark a tit-for-tat trade conflict between Europe and the U.S. to further destabilize a fragile global economy in the recent dawn of an interim partial trade deal between China and America.

The major trans-Atlantic stock markets from S&P 500, Dow Jones, and Nasdaq to FTSE and Euro Stoxx 50 plunge substantially in response to the new resolution of a 15-year trade dispute between Europe and America. As of October 2019 the U.S. trade institution targets Britain, France, Germany, and Spain as the main Eurozone consortium countries for Airbus airplane production. As U.S. trade envoy Robert Lighthizer suggests, the WTO confirms that the U.S. can impose countermeasures in response to the European illegal subsidies for Airbus. Lighthizer seeks to begin new trade negotiations with European counterparts to resolve this complex issue in a consistent way that would benefit American workers.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-09 11:35:00 Friday ET

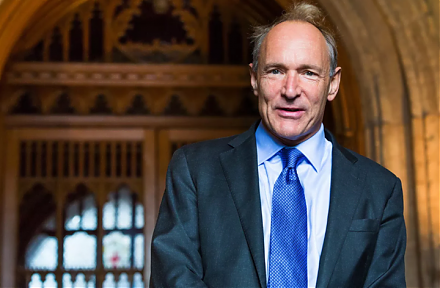

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2025-06-21 10:25:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why emotional intelligence can serve as a more important critical succ

2018-08-27 09:35:00 Monday ET

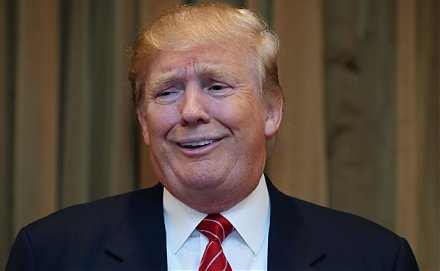

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I