2019-05-17 15:24:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

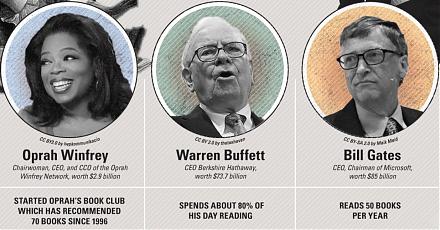

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments and 401(k) and other individual retirement accounts to optimize their own net worth and wealth accumulation. Living within our means is a primary strength in the long run. It might be even better for us to live below our means with frugal habits. Instead of overspending on high rent and overhead expenditures, we should save enough to invest in blue-chip stocks with steady cash dividends and long-term capital gains.

Further, tax-sensitive investors should maintain a multi-year time horizon for wise stock investment decisions. In this light, long-run stock investors can exponentially compound multiple streams of passive income over many years. For instance, if the investor saves $100,000 to buy stocks with 11% average equity market return performance over 30 years, the eventual wealth accumulation amounts to almost 23 times the initial outlay (i.e. $2.29 million in total). It is therefore important for us to learn the fact that we cannot buy happiness sooner rather than later. On balance, we should invest patiently in our skill sets and money matters by learning to delay immediate gratification over time. Patience pays well.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2018-07-05 13:40:00 Thursday ET

U.S. trading partners such as the European Union, Canada, China, Japan, Mexico, and Russia voice their concern at the World Trade Organization (WTO) in ligh

2020-11-01 11:21:00 Sunday ET

Artificial intelligence continues to push boundaries for several tech titans to sustain their central disruptive innovations, competitive moats, and first-m

2025-10-07 10:30:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund