Search results : corporate social responsibility

2022-11-15 10:30:00 Tuesday ET

2022-11-05 11:32:00 Saturday ET

2022-10-25 11:31:00 Tuesday ET

2022-04-15 10:32:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-03-28 11:30:00 Tuesday ET

The Federal Reserve System conducts monetary policy decisions, interest rate adjustments, and inter-bank payment operations. Peter Conti-Brown (2017)

2017-11-23 10:42:00 Thursday ET

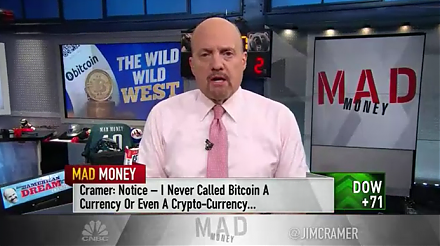

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2020-01-01 13:39:00 Wednesday ET

President Trump approves a phase one trade agreement with China. This approval averts the introduction of new tariffs on Chinese imports. In return, China s

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti