2018-04-11 09:37:00 Wednesday ET

North Korean leader and president Kim Jong-Un seeks peaceful resolution and denuclearization on the Korean Peninsula. When *peace* comes to shove, Asia

2018-01-04 07:36:00 Thursday ET

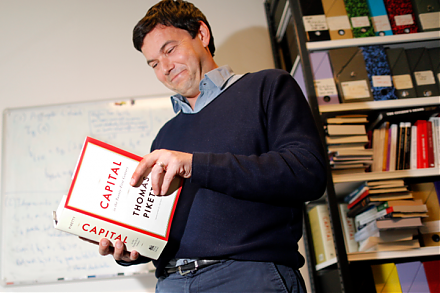

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2018-03-13 07:34:00 Tuesday ET

From crony capitalism to state capitalism, what economic policy lessons can we learn from President Putin's current reign in Russia? In the 15 years of

2018-03-07 07:34:00 Wednesday ET

President Trump tweets his key decision to oust State Secretary Rex Tillerson after several months of intense disagreement over diplomatic affairs. Trump so

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2020-06-03 09:31:00 Wednesday ET

Lean enterprises often try to incubate disruptive innovations with iterative continuous improvements and inventions over time. Trevor Owens and Obie Fern