Home > Personal Investment Vitae

AYA fintech network platform founder

Location: Taiwan

Gender: Male

Asset investment style: Quantitative fundamental analysis

Market capitalization:

$8,480,169talentsVirtual portfolio value:

$8,172,379talentsNet overall return per annum:

27.86%AYA current rank order:

#1Asset investment philosophy:

I invest in tech value stocks or platform enterprises with substantial network effects, scale economies, and information cascades etc such as Facebook, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (FAMGANT). All of these platform enterprises reap rewards in the form of both exponential user growth and revenue generation. The long-term fundamental intrinsic value steadily rises over time. One of my favorite stock investment strategies involves buying tech value stocks with competitive moats and first-mover advantages when their share prices fall below the respective book values.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| TSLA | Tesla Inc. Common Stock | $235.14 | $560.55 | 1,276 | +138.39% | $415,223 |

| Strategy : Elon Musk envisions a bold fantastic future with his professional trifecta of lean enterprises SolarCity, SpaceX, and Tesla. | ||||||

| AAPL | Apple Inc. Common Stock | $187.30 | $248.23 | 3,300 | +35.22% | $201,069 |

| Strategy : Apple retains its niche specialty and competitive moat in mobile devices, online connections, music streams, and apps etc. | ||||||

| NVDA | NVIDIA Corporation Common Stock | $216.31 | $605.09 | 462 | +179.73% | $179,616 |

| Strategy : Nvidia specializes in the continuous flow of lean GPU microchip production for high-performance computers and mobile devices. | ||||||

| PYPL | PayPal Holdings Inc. Common Stock | $92.72 | $258.65 | 1,079 | +178.96% | $179,038 |

| Strategy : PayPal continues to dominate in fintech conglomeration with fast and safe email payments and electronic transfers in America and many other parts of the world. | ||||||

| GOOG | Alphabet Inc. Class C Capital Stock | $1,114.91 | $2,757.57 | 90 | +147.34% | $147,839 |

| Strategy : Google continues to be the long prevalent online search engine with substantially greater AI cloud services such as Gemini, NotebookLM, and Google Cloud machine-learning algorithms. | ||||||

| TSLA | Tesla Inc. Common Stock | $560.55 | $1,374.39 | 178 | +145.19% | $144,864 |

| Strategy : Elon Musk envisions a bold fantastic future with his professional trifecta of lean enterprises SolarCity, SpaceX, and Tesla. | ||||||

| FB | Meta Platforms Inc. Class A Common Stock | $154.47 | $316.92 | 647 | +105.17% | $105,105 |

| Strategy : Meta continues to be the successful conglomeration of social media services with Facebook, Instagram, and Oculus. | ||||||

| AAPL | Apple Inc. Common Stock | $248.23 | $437.50 | 403 | +76.25% | $76,276 |

| Strategy : Apple retains its niche specialty and competitive moat in mobile devices, online connections, music streams, and apps etc. | ||||||

| LN | LINE Corporation | $31.74 | $48.51 | 3,151 | +52.84% | $52,842 |

| Strategy : LINE is the popular WhatsApp-equivalent app with many fun stickers and mobile services. | ||||||

| NVDA | NVIDIA Corporation Common Stock | $148.10 | $216.31 | 676 | +46.06% | $46,110 |

| Strategy : Nvidia specializes in the continuous flow of lean GPU microchip production for high-performance computers and mobile devices. | ||||||

| Sum | $1,547,982 | |||||

Top 10 current stock portfolio positions as of July 2025Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| IONQ | IonQ Inc. Common Stock | $44.84 | 25,610 | $1,148,352 |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | $245.60 | 2,054 | $504,462 |

| Strategy : The semiconductor trailblazer has surpassed Intel in terms of market capitalization. | ||||

| NET | Cloudflare Inc. Class A Common Stock | $191.25 | 2,550 | $487,687 |

| GS | Goldman Sachs Group Inc. (The) Common Stock | $705.84 | 647 | $456,678 |

| Strategy : Goldman Sachs remains one of the top investment banks in America and many other parts of the world. | ||||

| TME | Tencent Music Entertainment Group American Depositary Shares each representing two Class A Ordinary Shares | $22.36 | 17,094 | $382,221 |

| MSFT | Microsoft Corporation Common Stock | $511.70 | 719 | $367,912 |

| Strategy : Microsoft retains its competitive moats in software and cloud service provision. | ||||

| AAPL | Apple Inc. Common Stock | $210.02 | 1,570 | $329,731 |

| Strategy : Apple retains its niche specialty and competitive moat in mobile devices, online connections, music streams, and apps etc. | ||||

| JPM | JP Morgan Chase & Co. Common Stock | $289.90 | 1,136 | $329,326 |

| Strategy : JPMorgan Chase retains competitive advantages in U.S. retail mortgages, auto loans, credit cards, as well as commercial real estate loans. | ||||

| ORCL | Oracle Corporation Common Stock | $248.75 | 1,240 | $308,450 |

| Strategy : Oracle provides new AI cloud services and relational databases in support of better enterprise solutions. | ||||

| WFC | Wells Fargo & Company Common Stock | $79.71 | 3,676 | $293,013 |

| Sum | $4,607,832 | |||

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @MaryK | @Ramiro Acahua | @Esteban Coronel | @Manuel Reyes |

| @alin | @Will Ramsey | @Pierre Desir | @Sam |

| @AYA-Admin | @J.r. Eubanks | @Jose | @Saab |

| @Nicolas Lopez | @Adan Lemus | @Jose Rios | @Deano |

| @Andres Diaz Vega | @Ed Sizemore | @Jibey Arafa | @Manuel Roque |

Top 20 followers

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai

2017-12-17 11:41:00 Sunday ET

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable inv

2018-05-09 08:31:00 Wednesday ET

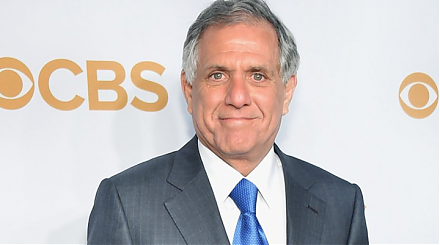

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2023-10-07 10:24:00 Saturday ET

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects. Thomas Philippon (20

2017-05-31 06:36:00 Wednesday ET

The Federal Reserve rubber-stamps the positive conclusion that all of the 34 major banks pass their annual CCAR macro stress tests for the first time since

2019-03-27 11:28:00 Wednesday ET

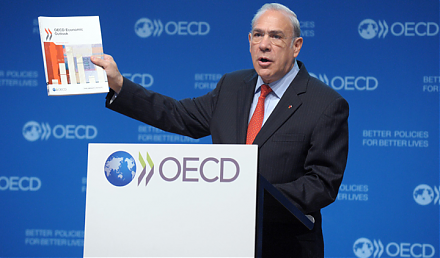

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction