Home > Personal Investment Vitae

Market capitalization:

$1,000,000talentsVirtual portfolio value:

$1,000,000talentsNet overall return per annum:

0.00%AYA current rank order:

#217Top 20 investors

Top 20 influencers

2018-02-07 06:38:00 Wednesday ET

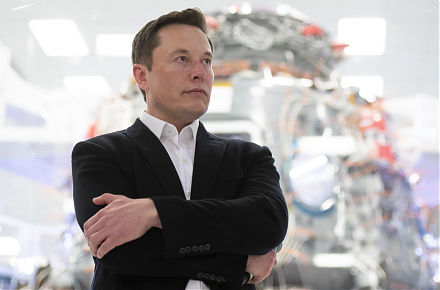

The new Fed chairman Jerome Powell faces a new challenge in the form of both core CPI and CPI inflation rate hikes toward 1.8%-2.1% year-over-year with stro

2025-06-20 08:27:00 Friday ET

President Trump poses new threats to Fed Chair monetary policy independence again. We describe, discuss, and delve into the mainstream reasons, conc

2017-02-13 09:35:00 Monday ET

JPMorgan Chase CEO Jamie Dimon says President Trump has now awaken the *animal spirits* in the U.S. stock market. The key phrase, animal spirits, is the

2023-02-28 10:27:00 Tuesday ET

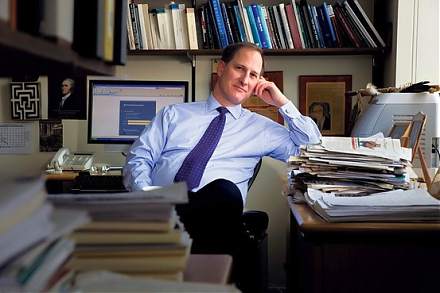

Basic income reforms can contribute to better health care, public infrastructure, education, technology, and residential protection. Philippe Van Parijs

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2017-05-01 09:45:00 Monday ET

Apple now pursues an early harvest strategy that focuses on extracting healthy profits from a relatively static market for the Mac, iPhone, and iPad, all of