Home > Personal Investment Vitae

Location: United States

Gender: Male

Asset investment style: Qualitative fundamental analysis

Market capitalization:

$7,441,161talentsVirtual portfolio value:

$4,433,265talentsNet overall return per annum:

17.57%AYA current rank order:

#17Asset investment philosophy:

Joseph Corr trades U.S. stocks with the top #301 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| SXTP | 60 Degrees Pharmaceuticals Inc. Common Stock | $0.15 | $1.34 | 110,866 | +793.33% | $131,931 |

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 31,377 | +681.13% | $113,271 |

| XBIOW | Xenetic Biosciences Inc. Warrants | $2.00 | $23.16 | 4,407 | +1,058.00% | $93,252 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 9,200 | +2,108.33% | $69,828 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 1,387 | +589.24% | $56,964 |

| HZNP | Horizon Therapeutics Public Limited Company Ordinary Shares | $16.41 | $98.56 | 589 | +500.61% | $48,386 |

| TUEM | Tuesday Morning Corp. Common Stock | $0.12 | $0.69 | 74,858 | +475.00% | $42,669 |

| NTZ | Natuzzi S.p.A. | $2.21 | $11.92 | 4,376 | +439.37% | $42,491 |

| MRNS | Marinus Pharmaceuticals Inc. Common Stock | $1.94 | $11.62 | 2,308 | +498.97% | $22,341 |

| BBX | BBX Capital Corporation | $2.54 | $14.54 | 1,545 | +472.44% | $18,540 |

| Sum | $639,673 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| HIMS | Hims & Hers Health Inc. Class A Common Stock | $23.84 | 1,135 | $27,058 |

| IMMX | Immix Biopharma Inc. Common Stock | $10.11 | 2,043 | $20,654 |

| DDD | 3D Systems Corporation Common Stock | $2.39 | 8,544 | $20,420 |

| NET | Cloudflare Inc. Class A Common Stock | $212.11 | 95 | $20,150 |

| CNR | Core Natural Resources Inc. Common Stock | $100.04 | 200 | $20,008 |

| STKE | Sol Strategies Inc. Common Shares | $1.55 | 12,882 | $19,967 |

| NBIS | Nebius Group N.V. Class A Ordinary Shares | $108.04 | 180 | $19,447 |

| CRWD | CrowdStrike Holdings Inc. Class A Common Stock | $441.54 | 44 | $19,427 |

| DFDV | DeFi Development Corp. Common Stock | $4.08 | 4,738 | $19,331 |

| AMR | Alpha Metallurgical Resources Inc. Common Stock | $189.48 | 101 | $19,137 |

| Sum | $205,599 |

Top 20 investors

Top 20 influencers

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

2018-04-11 09:37:00 Wednesday ET

North Korean leader and president Kim Jong-Un seeks peaceful resolution and denuclearization on the Korean Peninsula. When *peace* comes to shove, Asia

2018-09-03 09:31:00 Monday ET

Amazon follows Apple to become the second American public corporation to hit $1 trillion stock market valuation. Amazon's founder and chairman Jeff Bezo

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare

2018-07-27 10:35:00 Friday ET

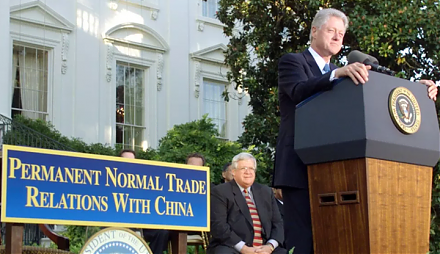

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2019-02-13 11:00:00 Wednesday ET

President Trump may reluctantly sign the congressional border wall deal in order to avert another U.S. government shutdown. With his executive power to decl