Home > Personal Investment Vitae

Location: United States

Gender: Male

Asset investment style: Quantitative technical analysis

Market capitalization:

$7,956,543talentsVirtual portfolio value:

$4,937,092talentsNet overall return per annum:

18.97%AYA current rank order:

#9Asset investment philosophy:

Jonah Whanau trades U.S. stocks with the top #326 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 65,309 | +681.13% | $235,765 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 3,446 | +589.24% | $141,527 |

| NTZ | Natuzzi S.p.A. | $2.21 | $11.92 | 10,868 | +439.37% | $105,528 |

| MPWR | Monolithic Power Systems Inc. Common Stock | $85.91 | $392.24 | 279 | +356.57% | $85,466 |

| SNPS | Synopsys Inc. Common Stock | $65.98 | $286.79 | 364 | +334.66% | $80,375 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 10,516 | +2,108.33% | $79,816 |

| MED | MEDIFAST INC Common Stock | $43.80 | $178.36 | 548 | +307.21% | $73,739 |

| TUEM | Tuesday Morning Corp. Common Stock | $0.12 | $0.69 | 123,283 | +475.00% | $70,271 |

| MRNS | Marinus Pharmaceuticals Inc. Common Stock | $1.94 | $11.62 | 2,646 | +498.97% | $25,613 |

| BBX | BBX Capital Corporation | $2.54 | $14.54 | 1,682 | +472.44% | $20,184 |

| Sum | $918,284 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| TTD | The Trade Desk Inc. Class A Common Stock | $29.28 | 1,252 | $36,658 |

| TRVI | Trevi Therapeutics Inc. Common Stock | $13.30 | 2,589 | $34,433 |

| IMMX | Immix Biopharma Inc. Common Stock | $9.29 | 3,697 | $34,345 |

| CRWD | CrowdStrike Holdings Inc. Class A Common Stock | $428.99 | 80 | $34,319 |

| TREE | LendingTree Inc. Common Stock | $42.90 | 798 | $34,234 |

| PLTR | Palantir Technologies Inc. Class A Common Stock | $157.16 | 217 | $34,103 |

| WDAY | Workday, Inc. | $151.04 | 223 | $33,681 |

| ZETA | Zeta Global Holdings Corp. Class A Common Stock | $18.84 | 1,760 | $33,158 |

| MHH | Mastech Digital Inc Common Stock | $6.66 | 4,964 | $33,060 |

| PAYC | Paycom Software Inc. Common Stock | $138.01 | 237 | $32,708 |

| Sum | $340,699 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @alin | |||

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

Top 20 favorite stocks

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| $PSX | |||

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative

2017-12-19 09:39:00 Tuesday ET

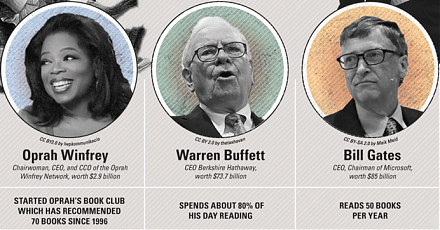

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2020-06-03 09:31:00 Wednesday ET

Lean enterprises often try to incubate disruptive innovations with iterative continuous improvements and inventions over time. Trevor Owens and Obie Fern

2020-03-19 13:39:00 Thursday ET

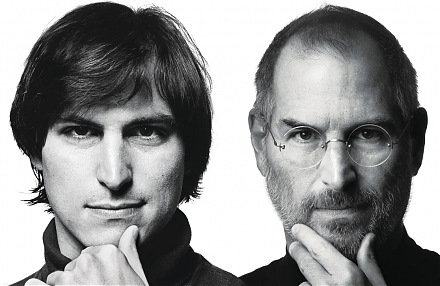

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2020-06-17 09:23:00 Wednesday ET

Successful founders focus on their continuous growth, passion, perseverance, and the collective wisdom of most team members. William Ferguson (2013) &