Home > Personal Investment Vitae

Location: United States

Gender: Male

Asset investment style: Quantitative technical analysis

Market capitalization:

$7,799,739talentsVirtual portfolio value:

$4,780,287talentsNet overall return per annum:

18.54%AYA current rank order:

#9Asset investment philosophy:

Jonah Whanau trades U.S. stocks with the top #326 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 65,309 | +681.13% | $235,765 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 3,446 | +589.24% | $141,527 |

| NTZ | Natuzzi S.p.A. | $2.21 | $11.92 | 10,868 | +439.37% | $105,528 |

| MPWR | Monolithic Power Systems Inc. Common Stock | $85.91 | $392.24 | 279 | +356.57% | $85,466 |

| SNPS | Synopsys Inc. Common Stock | $65.98 | $286.79 | 364 | +334.66% | $80,375 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 10,516 | +2,108.33% | $79,816 |

| MED | MEDIFAST INC Common Stock | $43.80 | $178.36 | 548 | +307.21% | $73,739 |

| TUEM | Tuesday Morning Corp. Common Stock | $0.12 | $0.69 | 123,283 | +475.00% | $70,271 |

| MRNS | Marinus Pharmaceuticals Inc. Common Stock | $1.94 | $11.62 | 2,646 | +498.97% | $25,613 |

| BBX | BBX Capital Corporation | $2.54 | $14.54 | 1,682 | +472.44% | $20,184 |

| Sum | $918,284 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| HIMS | Hims & Hers Health Inc. Class A Common Stock | $23.84 | 2,054 | $48,967 |

| IMMX | Immix Biopharma Inc. Common Stock | $10.11 | 3,697 | $37,376 |

| DDD | 3D Systems Corporation Common Stock | $2.39 | 15,458 | $36,944 |

| CNR | Core Natural Resources Inc. Common Stock | $100.04 | 363 | $36,314 |

| CRWD | CrowdStrike Holdings Inc. Class A Common Stock | $441.54 | 80 | $35,323 |

| ESCA | Escalade Incorporated Common Stock | $16.57 | 2,071 | $34,316 |

| ETON | Eton Pharmaceuticals Inc. Common Stock | $19.02 | 1,756 | $33,399 |

| PLTR | Palantir Technologies Inc. Class A Common Stock | $153.50 | 217 | $33,309 |

| TTD | The Trade Desk Inc. Class A Common Stock | $26.53 | 1,252 | $33,215 |

| NXT | Nextpower Inc. Class A Common Stock | $115.90 | 283 | $32,799 |

| Sum | $361,962 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @alin | |||

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

Top 20 favorite stocks

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| $PSX | |||

2023-11-14 08:24:00 Tuesday ET

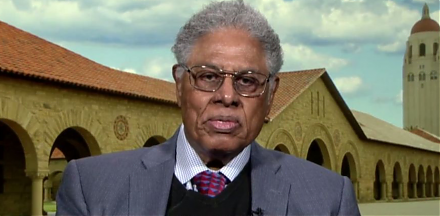

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2024-10-31 09:26:00 Thursday ET

Generative artificial intelligence (Gen AI) uses large language models (LLM) and content generation tools to enhance human lives with better productivity.

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2023-10-14 10:32:00 Saturday ET

Jonathan Baker frames the current debate over antitrust merger review and enforcement in America. Jonathan Baker (2019) The antitrust paradi

2018-04-29 13:44:00 Sunday ET

College education offers a hefty 8.8% pay premium for each marginal increase in the number of years of intellectual attainment in contrast to the 5.6%-6% lo

2019-05-03 11:29:00 Friday ET

Key tech unicorns blitzscale business niches for better scale economies from Uber and Lyft to Pinterest, Slack, and Zoom. LinkedIn cofounder and serial entr