Yangtze River Port and Logistics Limited, formerly Yangtze River Development Limited, incorporated on December 23, 2009, is a holding company. The Company conducts its operations through its subsidiary Energetic Mind Limited (Energetic Mind), which operates through its subsidiary Ricofeliz Capital (HK) Ltd (Ricofeliz Capital), which operates through its subsidiary Wuhan Yangtze River Newport Logistics Co., Ltd (Wuhan Newport), an enterprise that primarily engages in the business of real estate and infrastructural development with a port logistics center located in Wuhan, Hubei Province of China. Wuhan Newport primarily engages in the business of real estate and infrastructural development with a port logistics project located in Wuhan, Hubei Province of China. Wuhan Newport is an infrastructure development project. The Company's projects include the Wuhan Yangtze River Newport Logistics Center (the Logistics Center), which is a complex located in Wuhan. The project will include commercial buildings, professional logistic supply chain centers, direct access to the Yangtze River, Wuhan-Xinjiang-Europe Railway and ground transportation, storage and processing centers, and information technology (IT) supporting services, among others. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-09-23 12:25:00 Monday ET

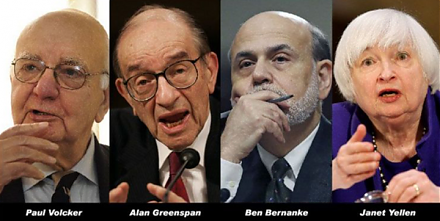

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2020-11-17 08:27:00 Tuesday ET

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation. Alan Weiss (2016)

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2017-12-13 06:39:00 Wednesday ET

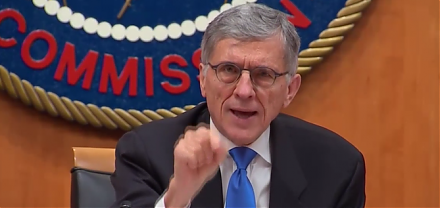

The Federal Communications Commission (FCC) has decided its majority vote to dismantle rules and regulations of most Internet service providers (ISPs) that