Vishay Precision Group, Inc. is a designer, manufacturer and marketer of resistive foil technology products such as resistive sensors, weighing modules, and control systems for a wide variety of applications. The Company provides vertically integrated products and solutions for multiple growing markets in the areas of stress measurement, industrial weighing, and manufacturing process control. Its product portfolio includes: Bulk Metal' foil resistors and sensors; Strain gages and instruments; Load cells; Modules; PhotoStress' products etc. The Company also provides systems to control process weighing in food, chemical, and pharmaceutical plants; force measurement systems used to control web tension in paper mills, roller force in steel mills, and cable tension in winch controls; on-board weighing systems installed in logging and waste-handling trucks; and special scale systems used for aircraft weighing and portable truck weighing. Vishay Precision Group, Inc. is based in Malvern, Pennsylvania....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-05-15 08:40:00 Tuesday ET

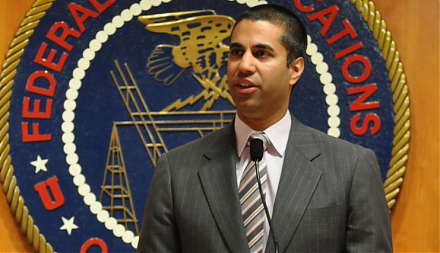

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2018-05-25 07:30:00 Friday ET

President Trump introduces $50 billion tariffs on Chinese products and new limits on Chinese high-tech investments in America. This new round of tariffs

2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis

2022-09-25 09:34:00 Sunday ET

Main reasons for share repurchases Temporary market undervaluation often induces corporate incumbents to initiate a share repurchase program to boost the

2019-04-13 14:28:00 Saturday ET

Saudi Aramco unveils the financial secrets of the most profitable corporation in the world. In its recent public bond issuance prospectus, Aramco offers the

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider