United Technologies Corporation provides technology products and services to the building systems and aerospace industries worldwide. It offers passenger and freight elevators, escalators, and moving walkways; modernization products to upgrade elevators and escalators; and maintenance and repair services. The company also provides building systems, including cooling, heating, ventilation, refrigeration, fire, flame, gas, smoke detection, portable fire extinguishers, fire suppression, intruder alarms, access control systems, video surveillance, and building control systems; and building services, such as audit, design, installation, system integration, repair, maintenance, and monitoring. In addition, it supplies aircraft engines for commercial, military, business jet, and general aviation markets; and provides aftermarket maintenance, repair, and overhaul, as well as fleet management services. Additionally, the company offers electric power generation, power management, and distribution systems; air data and aircraft sensing systems; engine control, intelligence, surveillance, and reconnaissance systems; engine components; environmental control systems; fire and ice detection, and protection systems; propeller systems; engine nacelle systems; aircraft lighting, seating, and cargo systems; actuation and landing systems; space products and subsystems; avionics systems; precision targeting; electronic warfare and range systems; flight controls, communications, navigation, oxygen, and simulation and training systems; food and beverage preparation, and storage and galley systems; and lavatory and wastewater management systems. It provides its services through sales representatives, building contractors and owners, transportation companies and retail stores, and through joint ventures, independent sales representatives, distributors, wholesalers, and dealers. United Technologies Corporation was incorporated in 1934 and is headquartered in Farmington, Connecticut....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc

2020-02-05 10:28:00 Wednesday ET

Our proprietary AYA fintech finbuzz essay shines light on the modern collection of business insights with executive annotations and personal reflections. Th

2018-05-07 07:32:00 Monday ET

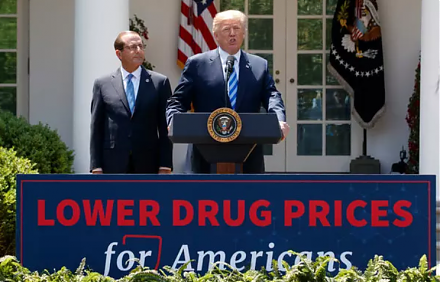

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2018-05-17 07:41:00 Thursday ET

Has America become a democratic free land of crumbling infrastructure, galloping income inequality, bitter political polarization, and dysfunctional governa

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2017-05-31 06:36:00 Wednesday ET

The Federal Reserve rubber-stamps the positive conclusion that all of the 34 major banks pass their annual CCAR macro stress tests for the first time since