T-Mobile US, Inc. is a national wireless service provider. The company offers its services under the T-Mobile, Metro by T-Mobile and Sprint brands. T-Mobile, through its subsidiaries, provides wireless services for branded postpaid and prepaid, and wholesale customers. The company was formed after the merger of T-Mobile USA Inc. and MetroPCS Communications Inc. Deutsche Telekom AG was the owner of the former T-Mobile USA Inc. Under the terms of the business combination with MetroPCS, Deutsche Telekom received shares of common stock representing a majority ownership interest in T-Mobile in exchange for its transfer of all of T-Mobile USA's common stock. The company offers mobile voice, messaging and data services in the postpaid, prepaid and wholesale markets. T-Mobile is extensively deploying 5G and 4G LTE (Long-Term Evolution) networks. It also provides wireless devices, such as smartphones, tablets and other mobile communication devices and accessories manufactured by various suppliers....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-03 10:38:00 Thursday ET

American parents often worry about money and upward mobility for their children. A recent New York Times survey suggests that nowadays American parents spen

2017-05-19 09:39:00 Friday ET

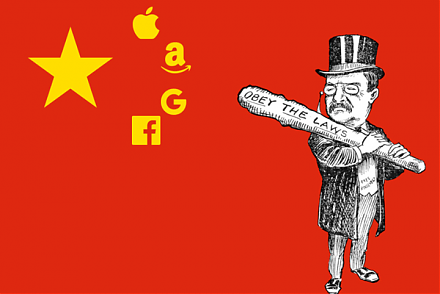

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock

2019-07-03 11:35:00 Wednesday ET

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2023-02-14 09:31:00 Tuesday ET

Eric Posner and Glen Weyl propose radical reforms to resolve key market design problems for better democracy and globalization. Eric Posner and Glen Weyl

2018-02-15 07:43:00 Thursday ET

Fed minutes reflect gradual interest rate normalization in response to high inflation risk. FOMC members revise up the economic projections made at the Dece

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)