State Street Corporation is a financial holding company. It provides a range of products and services for institutional investors worldwide through its subsidiaries. The company primarily performs its business through its principal banking subsidiary, State Street Bank. Its customers include providers of mutual funds, managers of collective investment funds and other investment pools, providers of corporate and public retirement plans, insurance companies, foundations, endowments and investment managers. State Street's Investment Servicing division offers a range of services, including custody, product-and participant-level accounting, daily pricing and administration; master trust and master custody; recordkeeping; shareholder accounting; foreign exchange, brokerage and other trading; securities finance; deposit and short-term investment facilities; loans and lease financing; outsourcing of investment manager and hedge fund manager operations, as well as performance, risk and compliance analytics....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-07-07 10:33:00 Saturday ET

The east-west tech rivalry intensifies between BATs (Baidu, Alibaba, and Tencent) and FAANGs (Facebook, Apple, Amazon, Netflix, and Google). These Sino-U.S.

2017-06-21 05:36:00 Wednesday ET

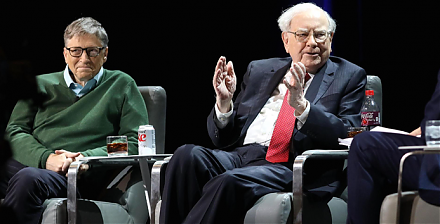

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2025-10-07 10:30:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-01-08 17:46:00 Tuesday ET

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)

2020-05-28 15:37:00 Thursday ET

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth. Laure Reillier and Benoit