Perella Weinberg Partners is an independent advisory firm. It provide strategic and financial advice to a broad client base, including corporations, institutions, governments, sovereign wealth funds and private equity investors. The company operates principally in New York, Houston, London, Calgary, Chicago, Denver, Los Angeles, Paris, Munich and San Francisco. Perella Weinberg Partners, formerly known as FinTech Acquisition Corp. IV, is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-02-07 08:26:00 Tuesday ET

Michel De Vroey delves into the global history of macroeconomic theories from real business cycles to persistent monetary effects. Michel De Vroey (2016)

2019-03-25 17:30:00 Monday ET

America seeks to advance the global energy dominance agenda by toppling Saudi Arabia as the top oil exporter by 2024. The International Energy Agency (IEA)

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm

2024-03-26 09:30:00 Tuesday ET

Stock Synopsis: ESG value and momentum stock market portfolio strategies Since 2013, we have been delving into the broad topics of ESG (Environmental, So

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has

2020-05-07 08:26:00 Thursday ET

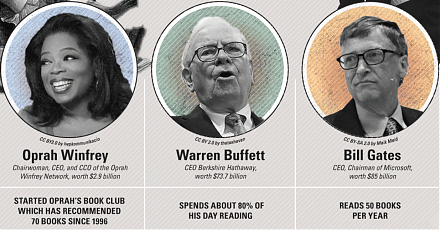

Disruptive innovators often apply their 5 major pragmatic skills in new blue-ocean niche discovery and market share dominance. Jeff Dyer, Hal Gregersen,