NetEase, Inc. is an Internet technology company engaged in the development of applications, services and other technologies for the Internet in China. It provides online gaming services that include in-house developed massively multi-player online role-playing games and licensed titles. NetEase also provides online advertising, community services, entertainment content, free e-mail services and micro-blogging services. The Company also offers wireless value-added services such as news and information content, matchmaking services, music and photos from the web that are sent over SMS, MMS, WAP, IVR and Color Ring-back Tone technologies. NetEase, Inc., formerly known as NetEase.com, Inc., is based in Beijing, the People's Republic of China....

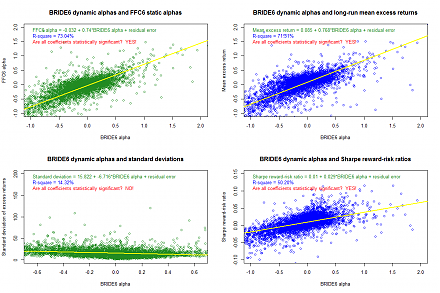

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark