NetEase, Inc. is an Internet technology company engaged in the development of applications, services and other technologies for the Internet in China. It provides online gaming services that include in-house developed massively multi-player online role-playing games and licensed titles. NetEase also provides online advertising, community services, entertainment content, free e-mail services and micro-blogging services. The Company also offers wireless value-added services such as news and information content, matchmaking services, music and photos from the web that are sent over SMS, MMS, WAP, IVR and Color Ring-back Tone technologies. NetEase, Inc., formerly known as NetEase.com, Inc., is based in Beijing, the People's Republic of China....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-10-07 12:35:00 Monday ET

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Res

2022-03-05 09:27:00 Saturday ET

Addendum on empirical tests of multi-factor models for asset return prediction Fama and French (2015) propose an empirical five-factor asset pricing mode

2024-03-26 09:30:00 Tuesday ET

Stock Synopsis: ESG value and momentum stock market portfolio strategies Since 2013, we have been delving into the broad topics of ESG (Environmental, So

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include

2018-05-15 08:40:00 Tuesday ET

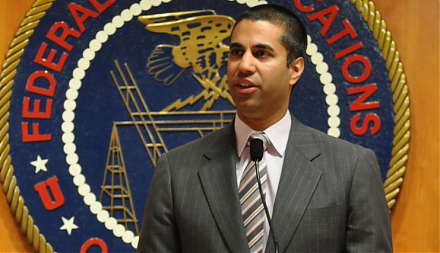

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2025-08-09 11:31:00 Saturday ET

Wharton e-commerce entrepreneurship professor Dr Karl Ulrich explains that many top-notch universities now provide massive open online courses (MOOCs) for m