Microsoft Corporation is one of the largest broad-based technology providers in the world. The company dominates the PC software market with more than 80% of the market share for operating systems. The company's Microsoft 365 application suite is one of the most popular productivity software globally. It is also now one of the two public cloud providers that can deliver a wide variety of infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) solutions at scale. Microsoft's products include operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools and video games. The company designs and sells PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories. Through Azure, it offers cloud-based solutions that provide customers with software, services, platforms and content....

+See MoreSharpe-Lintner-Black CAPM alpha (2.66%) Fama-French (1993) 3-factor alpha (3.55%) Fama-French-Carhart 4-factor alpha (4.33%) Fama-French (2015) 5-factor alpha (5.14%) Fama-French-Carhart 6-factor alpha (5.91%) Dynamic conditional 6-factor alpha (11.59%) Last update: Saturday 7 March 2026

2018-01-21 07:25:00 Sunday ET

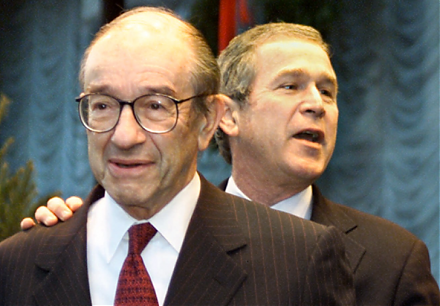

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2025-10-04 13:37:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-06-17 11:25:00 Monday ET

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent tim

2017-12-14 12:41:00 Thursday ET

Federal Reserve raises the interest rate by 25 basis points to the target range of 1.25% to 1.5% as FOMC members revise up their GDP estimate from 2% to 2.5

2019-10-09 16:46:00 Wednesday ET

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form

2018-11-01 08:36:00 Thursday ET

Ford and Baidu team up to test autonomous cars in China. For the next few years, Ford and Baidu plan to collaborate on the car design and user acceptance te