Micro Focus International plc is an infrastructure software company which develops, sells and supports software products and solutions. The Company's products include Access Manager, Access Review, AccuRev, AccuSync, Acu4GL, AcuBench, ACUCOBOL-GT, AcuConnect, AcuServer, AcuSQL, AcuXDBC, Aegis, AppManager, Artix, Atlas, Business Continuity Clustering, Caliber, Client for Windows, Cloud Manager and CloudAccess. It principally serves federal, airlines and healthcare industries. The company operates primarily in the United Kingdom, the United States, Germany, France, Japan and internationally. Micro Focus International plc is headquartered in Newbury, the United Kingdom....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-03-03 05:39:00 Friday ET

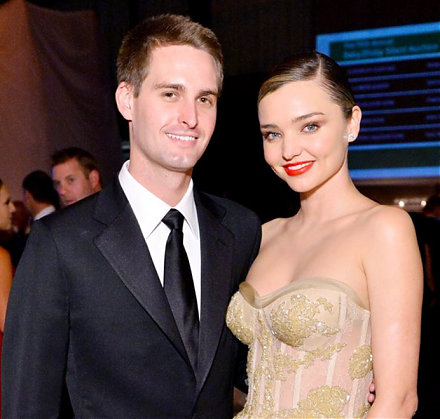

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2018-08-07 07:33:00 Tuesday ET

President Trump sounds smart when he comes up with a fresh plan to retire $15 trillion national debt. This plan entails taxing American consumers and produc

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)

2018-05-25 07:30:00 Friday ET

President Trump introduces $50 billion tariffs on Chinese products and new limits on Chinese high-tech investments in America. This new round of tariffs