Mercer International Inc. owns and operates a diverse pulp and paper business in the southern German states of Saxony and Thuringia, in the former East Germany. The Company operates it's pulp business primarily through its subsidiaries, Spezialpapierfabrik Blankenstein GmbH and Zellstof-und Papierfabrik Rosenthal GmbH & Co. KG , and conducts its paper business through another subsidiary, Dresden Papier GmbH....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2020-06-24 09:32:00 Wednesday ET

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom. Renee Martin and Don Martin (2010

2023-07-28 11:28:00 Friday ET

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most U.S. public corpor

2017-12-19 09:39:00 Tuesday ET

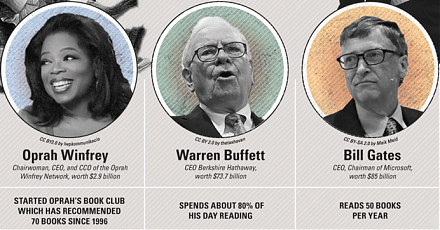

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs: