IBM is an information technology (IT) company. IBM has been divided into two parts: IBM and Kyndryl. IBM is addressing the hybrid cloud and AI opportunity with a platform-centric approach focused on providing two primary sources of client value: technology and business expertise. IBM provides integrated solutions and products that leverage data, information technology, deep expertise in industries and business processes, trust and security, and a broad ecosystem of partners and alliances. Its hybrid cloud platform and AI technology and services capabilities support clients' digital transformations and help the company engage with its customers and employees in new ways. The company operates in five segments: software, consulting, infrastructure, financing, and others. IBM purchased all of Red Hat, Inc.'s outstanding stock. Red Hat is reported within the Software segment, in Hybrid Platform & Solutions....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-03-09 08:33:00 Friday ET

David Solomon succeeds Lloyd Blankfein as the new CEO of Goldman Sachs. Unlike his predecessors Lloyd Blankfein and Gary Cohn, Solomon has been an investmen

2017-03-03 05:39:00 Friday ET

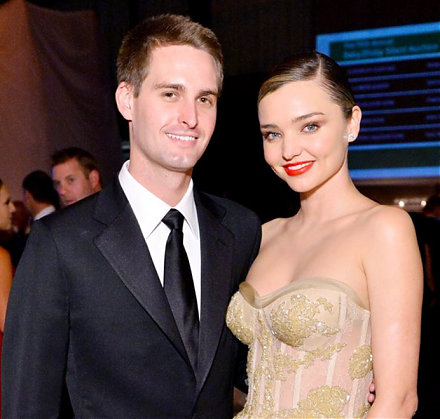

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2020-09-17 12:28:00 Thursday ET

Many successful business organizations develop their distinctive capabilities and unique value propositions for strategic reasons. Paul Leinwand and Cesa

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo