The Goodyear Tire & Rubber Company is one of the largest tire manufacturing companies in the world, selling under Goodyear, Kelly, Dunlop, Fulda, Debica, Sava and various other house brands (such as, Lee, Kingstone, Douglas, Mohave and Republic) as well as private-label brands (Roadhandler, Star and Monarch). It sells tires, undertakes automotive repairs and provides other services. It has 3 geographical segments. Americas, the largest in terms of revenue, develops, manufactures, distributes and sells tires and related products and services in North, Central and South America, and sells tires to various export markets. Europe, Middle East and Africa, the company's second largest segment, develops, manufactures, distributes and sells tires for automobiles, trucks, buses, aircraft, motorcycles, and earthmoving, mining and industrial equipment across Europe, the Middle East and Africa, and sells tires and Asia-Pacific segment does the same throughout the Asia Pacific region....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2023-08-31 10:22:00 Thursday ET

Government intervention remains a major influence over global trade, finance, and technology. Nowadays, many governments tend to eschew common ownership

2019-05-13 12:38:00 Monday ET

Brent crude oil prices spike to $70-$75 per barrel after the Trump administration stops waiving economic sanctions on Iranian oil exports. U.S. State Secret

2018-01-04 07:36:00 Thursday ET

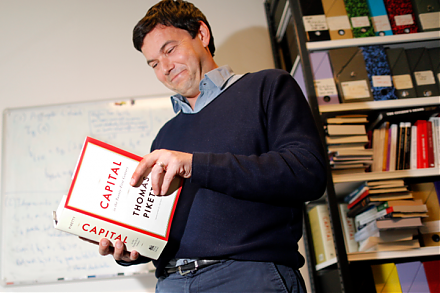

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include

2018-03-25 08:39:00 Sunday ET

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U