Establishment Labs Holdings Inc. is a medical technology company. It focuses on designing, developing, manufacturing and marketing portfolio of silicone gel-filled breast implants ae well as body shaping implants. The company's brand consists of Motiva Implants(R) and MotivaImagine (R) platform. Its technologies portfolio includes Divina 3D Simulation System(R), Puregraft and MotivaImagine Centers (R). Establishment Labs Holdings Inc. is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues

2019-04-26 09:33:00 Friday ET

JPMorgan Chase CEO Jamie Dimon defends capitalism in his recent annual letter to shareholders. As Dimon explains here, socialism inevitably produces stagnat

2024-10-27 07:56:01 Sunday ET

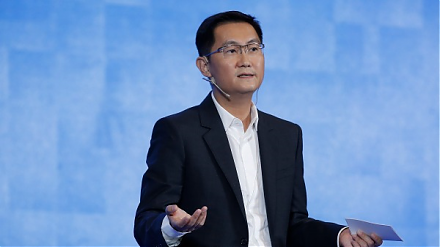

Stock Synopsis: China Internet tech titans continue to grow amid greater competition. We launch our unique coverage of top 25 China Internet stocks. In t

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2019-03-21 12:33:00 Thursday ET

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become