2018-01-02 12:39:00 Tue ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-15% tax payments that each large bank can spread over 8 years. Citigroup also expects to experience a temporary $20 billion net income hit due to offshore cash repatriation while Bank of America expects a similar one-time $3 billion net income hit. Several other banks such as JPMorgan Chase and Wells Fargo are likely to receive similar preferential treatment under the Trump tax holiday. This preferential tax treatment allows most financial institutions to repatriate offshore cash stockpiles to invest in domestic job creation, R&D innovation, and capital equipment usage.

In effect, the Trump tax holiday empowers multinational banks to experience short-term pains in exchange for long-term gains under the territorial tax system. This new tax law is a major legislative victory for the Trump administration with strong support from Republicans over the joint opposition of Democrats. The recent ripple effects apply not only to key multinational banks but also multinational corporations (especially tech titans such as Facebook, Apple, Microsoft, Google, and Amazon). Overall, the medium-to-long-term tax cuts can continue to extend the Trump stock market rally.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2019-12-10 09:30:00 Tuesday ET

Federal Reserve institutes the third interest rate cut with a rare pause signal. The Federal Open Market Committee (FOMC) reduces the benchmark interest rat

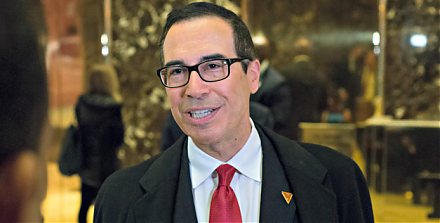

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

2019-08-14 10:31:00 Wednesday ET

Netflix suffers its first major loss of U.S. subscribers due to the recent price hikes. The company adds only 2.7 million new subscribers in 2019Q2 in stark