Esquire Financial Holdings, Inc. is a bank holding company. It provides banking products and services to law professionals, professional service firms, small to mid-sized businesses and individuals primarily in the United States. The company operates primarily in Garden City, New York; Palm Beach Gardens and Florida. Esquire Financial Holdings, Inc. is headquartered in Jericho, New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-08-31 14:39:00 Saturday ET

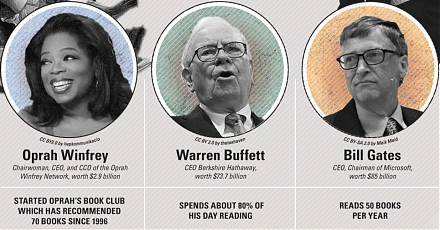

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2019-01-31 08:40:00 Thursday ET

We offer a free ebook on the latest stock market news, economic trends, and investment memes as of January 2019: https://www.dropbox.com/s/4d8z

2018-12-09 08:44:00 Sunday ET

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trum

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model