Castle Biosciences Inc. is a commercial-stage dermatological cancer company. It is focused on providing physicians and patients, clinically actionable genomic information. Castle Biosciences Inc. is based in Texas, United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2022-03-05 09:27:00 Saturday ET

Addendum on empirical tests of multi-factor models for asset return prediction Fama and French (2015) propose an empirical five-factor asset pricing mode

2017-04-25 06:35:00 Tuesday ET

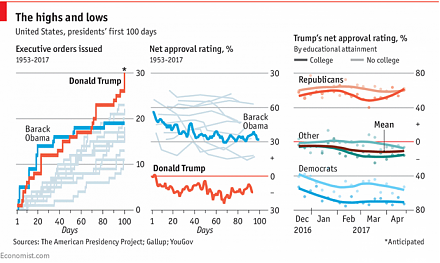

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2020-08-12 07:25:00 Wednesday ET

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2017-10-03 18:39:00 Tuesday ET

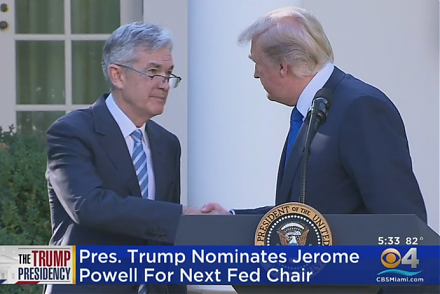

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2019-03-01 13:36:00 Friday ET

Global economic uncertainty now lurks in a thick layer of mystery. This uncertainty arises from Sino-U.S. trade tension, Brexit fallout, monetary policy nor

2019-09-23 12:25:00 Monday ET

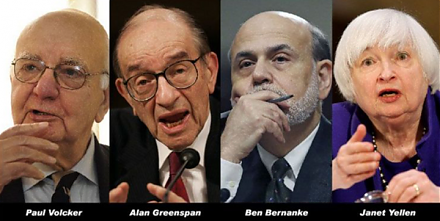

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit