Copa Holdings, through its main subsidiaries Copa Airlines and Copa Colombia, offers airline passenger and cargo services. On a daily basis, the company currently operates scheduled flights and flies to destinations covering countries in North, Central, South America and the Caribbean from its Panama City hub. Passengers of the carrier also have access to flights serving many more destinations, courtesy of its code-share arrangements with United Airlines among other carriers. The company launched its own frequent flyer program in a bid to boost its relationship with customers. The move followed its decision to stop co-branding the MileagePlus frequent flyer program in Latin America. Copa Holdings is constantly looking to modernize its fleet. The planes are equipped with modern facilities aimed at promoting safety, enhancing flying experience etc. Moving ahead, the company aims to increase its fleet size....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-10-03 17:39:00 Thursday ET

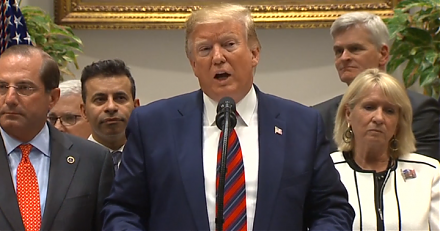

President Trump indicates that he would consider an interim Sino-American trade deal in lieu of a full trade agreement. The Trump administration defers high

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2018-05-17 07:41:00 Thursday ET

Has America become a democratic free land of crumbling infrastructure, galloping income inequality, bitter political polarization, and dysfunctional governa

2022-09-25 09:34:00 Sunday ET

Main reasons for share repurchases Temporary market undervaluation often induces corporate incumbents to initiate a share repurchase program to boost the

2017-10-15 07:38:00 Sunday ET

Ivanka Trump and Treasury Secretary Steven Mnuchin both press the case for GOP tax legislation as economic relief for the middle-class without substantial t

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr