Centene Corporation is a well-diversified, multi-national healthcare company that primarily provides a set of services to government sponsored healthcare programs. The company serves the under-insured and uninsured individuals through member-focused services. It is also engaged in providing education and outreach programs to inform and assist members in accessing quality, appropriate healthcare services. Through a diversified product portfolio and expanding geographic reach, Centene continues to deliver results by growing premium and service revenues profitably. The company operates in two segments: Managed Care and Specialty Services. Managed Care - This segment provides health plan coverage to individuals through Government subsidized programs, including Medicaid. Specialty Services - This segment consists of its specialty companies offering diversified healthcare services and products to state programs, correctional facilities, healthcare organizations, employer groups and other commercial organizations....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 24 January 2026

2018-01-25 08:32:00 Thursday ET

After its flagship iPhone X launch, Apple reports its highest quarterly sales revenue over $80 billion in the tech titan's 41-year history. Apple expect

2019-07-29 11:33:00 Monday ET

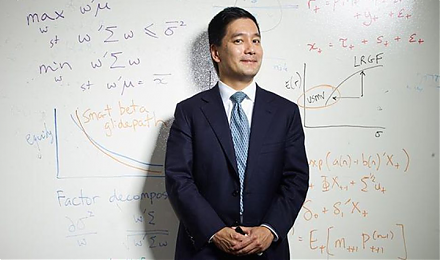

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter

2024-04-02 04:45:41 Tuesday ET

Stock Synopsis: High-speed 5G broadband and mobile cloud telecommunication In the U.S. telecom industry for high-speed Internet connections and mobile cl

2018-05-09 08:31:00 Wednesday ET

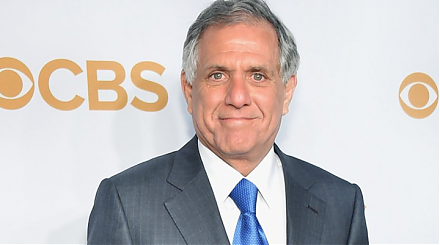

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant