Clean Harbors, Inc. is a leading provider of environmental, energy and industrial services in North America, wherein it operates the largest number of hazardous waste incinerators, landfills and treatment, storage and disposal facilities. It provides a broad range of services such as end-to-end hazardous waste management, emergency response, industrial cleaning and maintenance, and recycling services. Clean Harbors is also the largest re-refiner and recycler of used oil globally and the leading provider of parts washers and environmental services to commercial, industrial and automotive customers in North America. The company's strategy is to develop and maintain relationships with a diverse group of customers that seek environmental, energy or industrial services....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-04 11:41:00 Friday ET

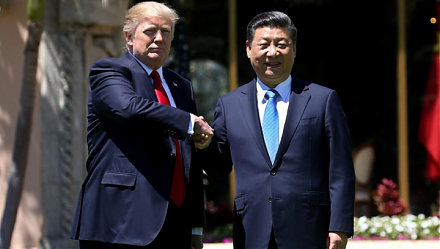

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2018-05-13 08:33:00 Sunday ET

Incoming New York Fed President John Williams suggests that it is about time to end forward guidance in order to stop holding the financial market's han

2016-11-09 00:00:00 Wednesday ET

Universally dismissed as a vanity presidential candidate when he entered a field crowded with Republican talent, the former Democrat and former Independent

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2019-05-13 12:38:00 Monday ET

Brent crude oil prices spike to $70-$75 per barrel after the Trump administration stops waiving economic sanctions on Iranian oil exports. U.S. State Secret

2020-07-26 15:29:00 Sunday ET

Firms and customers create value and wealth together by joining the continual flow of small batches of lean production to the lean consumption of cost-effec