CoreLogic, Inc., formerly known as First American Corp., is a provider of consumer, financial and property information, analytics and services to business and government. The Company combines public, contributory and proprietary data to develop predictive decision analytics and provide business services. CoreLogic has built databases for U.S. real estate, mortgage application, fraud, and loan performance and is also a provider of mortgage and automotive credit reporting, property tax, valuation, flood determination, and geospatial analytics and services. The Company serves various industries, including automotive, cable, financial services, employment, geospatial information service, insurance, legal, oil and gas, real estate, retail, utility, and telecommunications. CoreLogic, Inc. is headquartered in Santa Ana, California....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-09-19 05:34:00 Tuesday ET

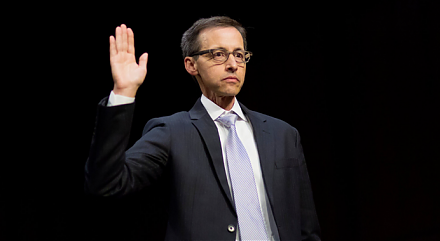

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2018-03-17 09:35:00 Saturday ET

Facebook faces a major data breach by Cambridge Analytica that has harvested private information from more than 50 million Facebook users. In a Facebook pos

2020-10-13 08:27:00 Tuesday ET

Agile lean enterprises strive to design radical business models to remain competitive in the face of nimble startups and megatrends. Carsten Linz, Gunter

2018-09-30 14:34:00 Sunday ET

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal cons

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2019-02-01 15:35:00 Friday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implem