CHS Inc., an integrated agricultural company, provides grains, foods, and energy resources to businesses and consumers worldwide. The company operates through four segments: Energy, Ag, Nitrogen Production, and Foods. It engages in the operation of petroleum refineries and pipelines; supply, marketing, and distribution of refined fuels, including gasoline, diesel fuel, and other energy products; blending, sale, and distribution of lubricants; and the supply of propane and other natural gas liquids. The company also processes and sells crude oil into refined petroleum products under the Cenex brand name to member cooperatives and other independent retailers through a network of approximately 1,500 sites; and provides transportation services. In addition, it is involved in the marketing of grains and oilseeds; and manufacture and sale of seeds, crop nutrients, crop protection products, animal feed, animal health products, refined fuels comprising ethanol and dried distillers grains with solubles etc....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-03-03 11:37:00 Saturday ET

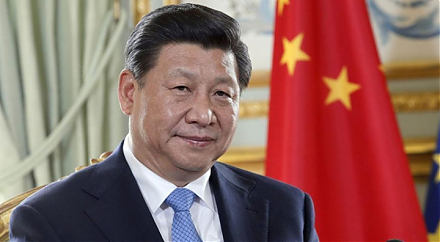

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2019-05-21 12:37:00 Tuesday ET

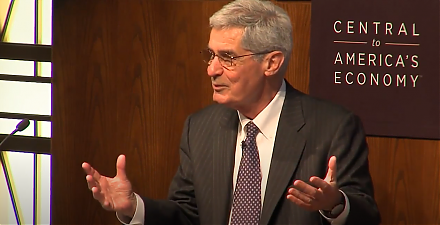

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2019-05-11 10:28:00 Saturday ET

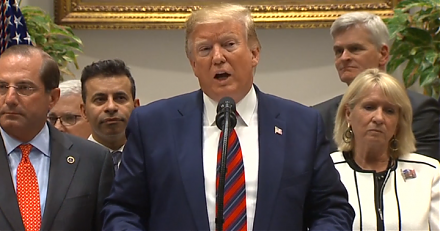

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2018-03-25 08:39:00 Sunday ET

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U

2023-02-07 08:26:00 Tuesday ET

Michel De Vroey delves into the global history of macroeconomic theories from real business cycles to persistent monetary effects. Michel De Vroey (2016)